The REPowerEU initiative has the potential to add at least 420 gigawatts (GW) of solar installations by 2030; however, rising solar raw material costs could become the stumbling block to achieving this goal, says Wood Mackenzie, a Verisk business (Nasdaq:VRSK).

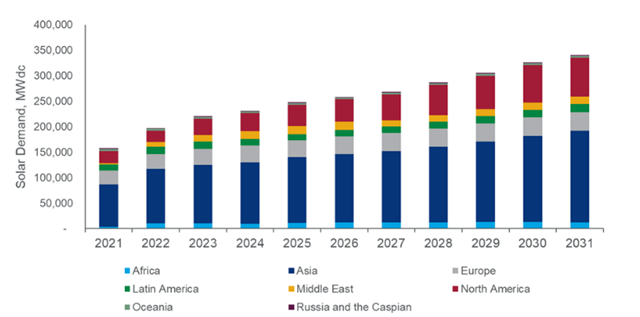

Global solar PV installations will grow at a compound annual rate of 8% between 2022 and 2031 to over 3,500 GW of total installed capacity. Europe is expected to account for over 9% or approximately 331 GW of installations within the period, with potential from the REPowerEU initiative to more than double the expected installations.

Global solar installation demand, 2021-2031

Source: Wood Mackenzie

Wood Mackenzie senior analyst Theo Theodorou said: “The global push to phase out fossil fuels and move to cleaner energy sources has driven innovation and policies that have resulted in tremendous cost reduction in the solar PV sector over the last two decades. However, last year, a perfect storm of covid disruptions, rapid recovery in demand from solar installations, fast-increasing freight rates, and high solar raw materials prices have pushed module prices more than 20% higher. Global prices for key raw materials such as polysilicon, silver, aluminium, copper and steel have all reached multiyear highs.”

Polysilicon, the main feedstock for producing wafers for crystalline silicon solar cells, has tripled in price over the last 18 months. This is due to covid restrictions and China’s power crunch resulting in delays in new capacity coming online. New polysilicon capacity in China has the potential to rebalance the market, but polysilicon prices are expected to stay elevated throughout 2022.

The main European producer, Germany’s Wacker Chemie, produces around 60 kilo-tonnes per annum of polysilicon, virtually all of which are exported to China, as there is not enough downstream capacity to consume this volume in Europe. For the region to consume its current polysilicon production it would need to increase its ingot and wafer manufacturing by a factor of 10 and further downstream manufacturing of cells and modules by 21-fold and 3-fold, respectively. To achieve REPowerEU goals and create a local solar supply chain, current capacities need even more aggressive expansions at 3 times more polysilicon, 20 times more wafers, 42 times more cells, and 6 times more modules.

Furthermore, the price for antireflective ultra-clear glass, the main material used for the front side cover of solar modules, is under pressure due to increasing costs of natural gas and tin. In addition, the balance of plant materials such as aluminium, galvanised steel and copper all saw price increases of more than 30% since last year and there is not a lot that can be done to reduce the intensity of use in the short term.

Theodorou said: “Europe is called to transform its energy system in the wake of the Russia/Ukraine war, with the REPowerEU initiative envisioning at least 420 GW of new solar capacity by 2030. But as more sanctions are on the way against Russia, and with electricity and fuel prices showing no sign of slowing down, Europe needs to navigate this high price environment and act fast to develop a local solar supply chain to achieve its targets.”