Polysilicon prices have seen a slight dip this week, and a significant production reduction is expected in June, according to Solarbe Consulting.

The average transaction price for n-type polysilicon fell to CNY 41.8/kg, and granular silicon dropped to CNY 35.3/kg, dropping 5.4% week-on-week. Prices for p-type polysilicon remained relatively stable.

Solarbe noted a notable uptick in polysilicon market transactions this week, coupled with increased inquiries. Several wafer manufacturers have ramped up their purchases, with some starting stockpiling.

Industry insiders reveal plans for significant production cutbacks in June, particularly among four major polysilicon enterprises.

One company is slated to reduce production by over 10,000 tons, while another has opted out of its reduction plans. Additionally, at least five second- and third-tier enterprises are anticipated to join the reduction efforts, with two planning to cease production entirely in June.

Recent directives from China’s State Council, including the “2024-2025 Energy Conservation and Carbon Reduction Action Plan,” emphasize optimizing non-ferrous metals’ production capacity and tightening new project approvals. The plan mandates that new polysilicon projects meet advanced energy efficiency standards.

Given the production cuts and heightened procurement demand, polysilicon output in June is anticipated to plummet by 30,000 to 40,000 tons, surpassing a 20% decrease. This could stabilize polysilicon inventory levels in the short term and trigger a price rebound.

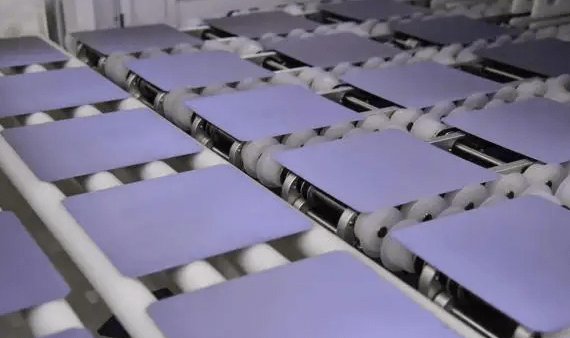

In the wafer and cell sectors, prices continued their decline this week. Intense market competition has led to price drops for various wafer models, prompting a rise in companies reducing or halting production.

Wafer prices are expected to remain low until production capacity normalizes.

The solar cell sector is also grappling with weakened downstream demand. While some leading TOPCon manufacturers have scaled back their operations, most companies remain cautious.

With inventory levels on the rise, there’s a looming risk of further price declines for solar cells.

Meanwhile, the module segment saw a slight decrease in prices this week. Solarbe’s statistics indicate that the average bid price for p-type modules in May was CNY 0.82/W, down 2.3% MoM.

Similarly, the average bid price for n-type modules dropped to CNY 0.874/W, down 1.2%.

Given shifts in policies, the installation market remains cautious, leading to a decline in module operating rates and a gradual uptick in inventory levels.

Overall, prices across the solar PV industrial chain continue to seek stability, with module prices facing downward pressure.