Silicon wafer giants LONGi and TCL Zhonghuan both reduced mono wafer prices last Friday in response to the plunge in polysilicon prices.

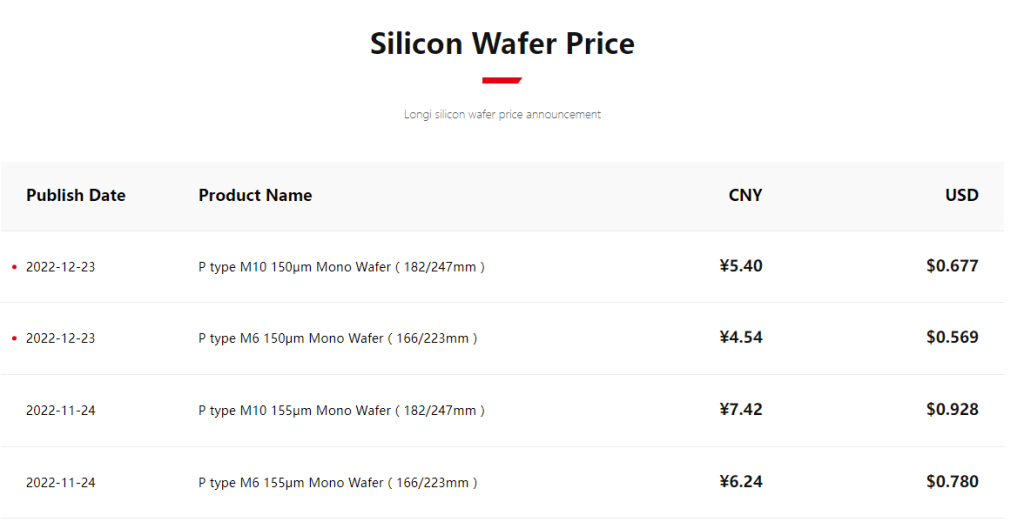

LONGi said its p-type 182 mm wafers are now priced at RMB 5.40 ($0.677), down 27.22%. P-type 166 mm wafers are now being sold for RMB 4.54 ($0.569), down 27.24%.

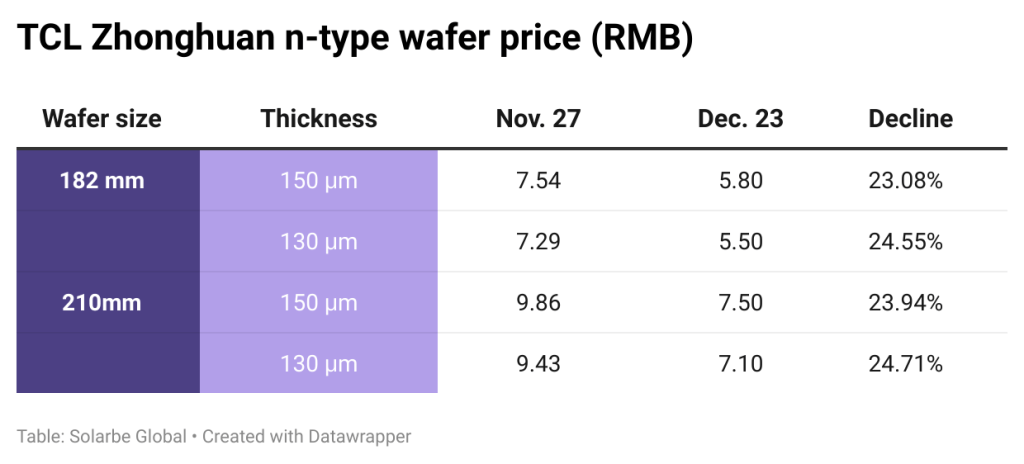

N-type wafer prices have also fallen sharply. The price of n-type wafers with 130 μm thickness is on par with that of 150 μm p-type wafers, giving n-type wafers a higher cost advantage.

While reducing wafer prices, LONGi has also cut wafer thickness from 155 μm to 150 μm. The last time the similar price has announced was in May 2021, when 170 μm-thick 182 mm wafers were priced at RMB 5.39.

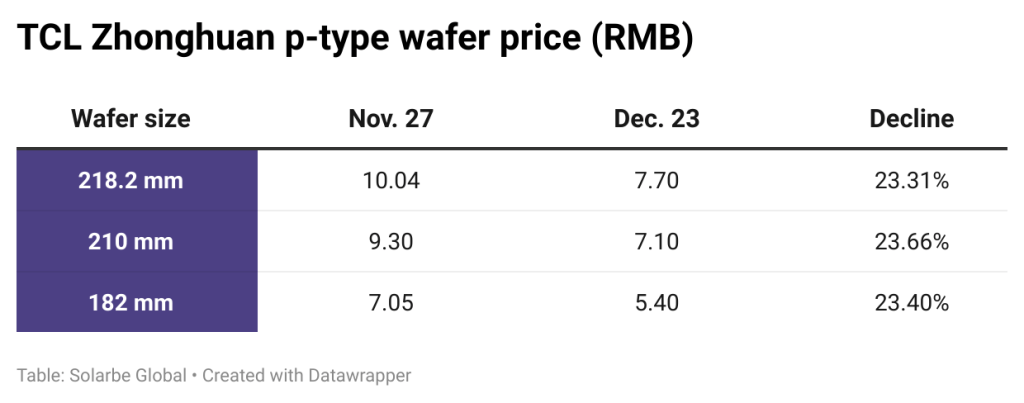

TCL Zhonghuan has also cut down its wafer prices by over 23%. Its p-type 182 mm wafer is now at RMB 5.40, the same as LONGi. The prices of 210 mm and 218.2 mm wafers have also been slashed to RMB 7.10 and RMB 7.70.

N-type wafer prices have also seen a major reduction. For 210 mm wafers, those with 150 μm thickness are now priced at RMB 7.50, while 130 μm ones now cost RMB 7.10.

For 182 mm wafers, the price of 150 μm-thick wafers has been lowered to RMB 5.80 and that of 130 μm wafers is now RMB 5.50.

Solarbe Consulting analysts believe that the reduction in silicon wafer prices reflects the impact of lower upstream material costs. As the supply and demand situation changes in the future, the price of solar wafers may continue to decline. According to sources at solar cell and module manufacturers, 130-135 μm wafer has been widely used on commercial n-type TOPCon cells.

As 130 μm n-type wafer is at a similar price to 150 μm p-type wafer, the advantages of n-type products in conversion efficiency can be fully demonstrated. It is conducive to n-type cells and modules occupying a higher market share. The price reduction is also believed to contribute to the vigorous development of the global PV market in 2023.