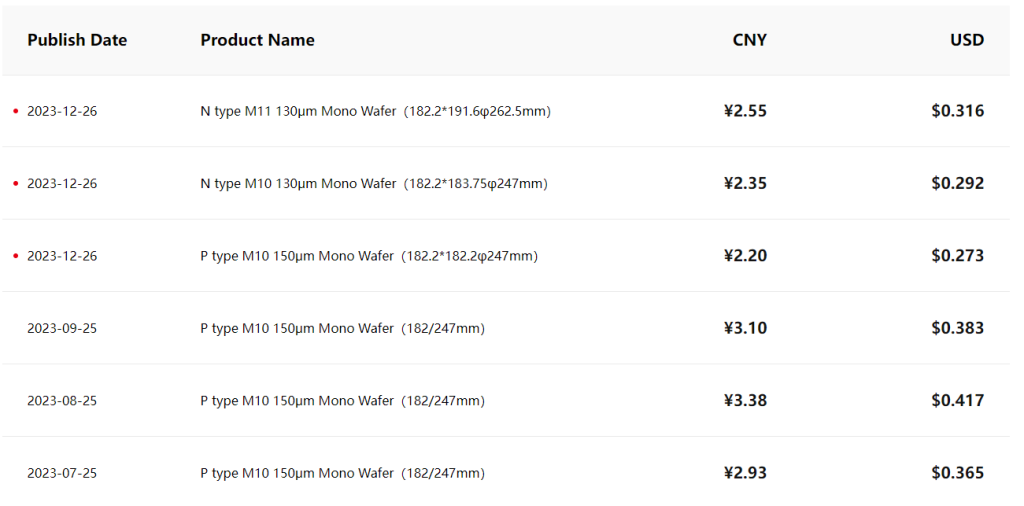

As 2023 draws to a close, the solar wafer market continues to witness a persistent downward trend in prices. On December 26, LONGi announced the prices of its mono wafers, reflecting the ongoing challenges faced by the industry.

The revealed prices include $0.292 for the n-type M10 wafer with a thickness of 130μm and $0.316 for the n-type M11 wafer with the same thickness. Notably, the p-type M10 wafer saw a 29% reduction in price from three months ago, now priced at $0.273.

Observers in the industry suggest that, with the year-end approaching, the market anticipates fierce competition in 2024. Consequently, many manufacturers are focusing on destocking, potentially intensifying the downward trajectory of wafer prices.

Winter has come

Data released on December 21 by China’s Silicon Industry Branch highlighted an irrational decline in wafer prices. The average transaction price for the M10 mono wafer (182mm/150μm) dropped to CNY 1.92/piece (~$0.269), marking a weekly decrease of 7.69%.

Last week, the average transaction price for the n-type mono wafer (182mm/130μm) reached CNY 2.18/piece (~$0.305), representing a 4.39% decrease, while the G12 mono wafer (210mm/150μm) recorded an average transaction price of CNY 3.02/piece (~$0.423), reflecting a 7.36% decrease.

Since 2023, the solar PV industry has experienced fluctuating prices, coupled with rapid advancements in cell technology, leading to unprecedented competition. Due to the high inventory levels of wafer manufacturers, prices have entered a “winter” period this year.

Analysts in the industry suggest that the decline in wafer prices is related to excess production capacity. In the second half of 2023, the PV industry witnessed a phase of excess capacity with a significant influx of capital and new players.

Anticipating Intense Competition in the Coming Year

Statistics released by China’s National Energy Administration on December 20 indicate a substantial increase in PV installations in November, with a month-on-month improvement of 56.5%. The cumulative PV installations for the year are expected to reach 180 GW, doubling compared to 2022.

Industry insiders predict that the PV market will continue to face intense competition in the first quarter of the upcoming year. Qu Xiaohua, chairman of Canadian Solar, publicly stated that the PV industry is currently undergoing an “unprecedented internal competition,” cautioning against high expectations for single-watt profitability in the coming year.

With heightened competition in the industry, experts foresee an accelerated pace of industry reshuffling. Simultaneously, leading PV companies are ramping up technological innovations to further enhance solar cell efficiency.