The recent rise in electricity prices will put pressure on power purchase agreements (PPA) for 10 years or more, and the current market turmoil heralds the arrival of the era of short-term PPA, according to Pexapark, a Zurich based renewable energy consultancy.

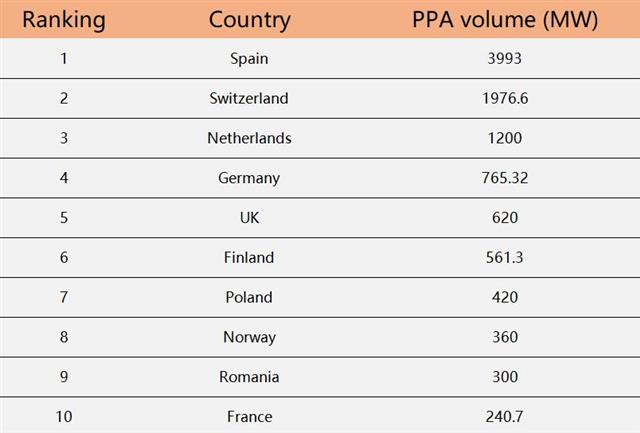

Data source: PexaQuote, top 10 countries in Europe with PPA signing volume in 2021

In the report on the European PPA Market Outlook 2022, experts pointed out that the price environment in the fourth quarter of 2021 will be remembered for many years, and its real impact will come into play in 2022.

Pexapark estimates that the total amount of PPAs in Europe will be 11.1 GW in 2021. The PPAs capacity of the enterprise would reach 6.5 GW, and Spain once again becomes the leading market with nearly 4 GW.

Data source: PexaQuote, top five countries in European PPA signing volume from 2019-2021

Many market participants are readjusting prices. As a result of the price increase in the fourth quarter, the main method used by utilities to manage PPA portfolio risk was severely impacted and the price correlation between hedging and PPA was broke.

In view of the current market, utility companies have increased discounts in an unprecedented way, up to 40%, and drastic changes are taking place. Industry insiders believed that the increase in the price discount of PPA based on production (paid according to production) has led to an increase in the demand for short-term PPA and base load contracts.

This is not only very different from the typical risk situation of traditional renewable energy investment, but also has an impact on the daily operation mode of power plants. In response, renewable energy funds and investors are creating a new generation of utilities.

The agency predicted three obvious trends of PPA this year, as, the pressure on the 10-year long-term PPA market will weaken in absolute numbers; the new large renewable energy investment fund will lead the rise of new utilities; and large business buyers will also increase.

As the market being maturer, renewable energy investors and operators will become larger and more diversified in technology and market, and will become more professional in managing energy risks.