Though there is already strong support for increasing the renewables target to 45% by 2030 within the European Parliament and various strong policies issued by the EU, huge hurdles lie ahead to achieve REPowerEU goals.

Solarbe last Thursday has invited Mr. Luis Contreras, Managing Director at Yingli Solar Europe; Mr. Daniel Tipping, Solar Analyst at Wood Mackenzie as well as Mr. Robin N Mota Dawson, Managing Director of Ideematec Spain, to participate in the discussion of future solar development of Europe under new policies.

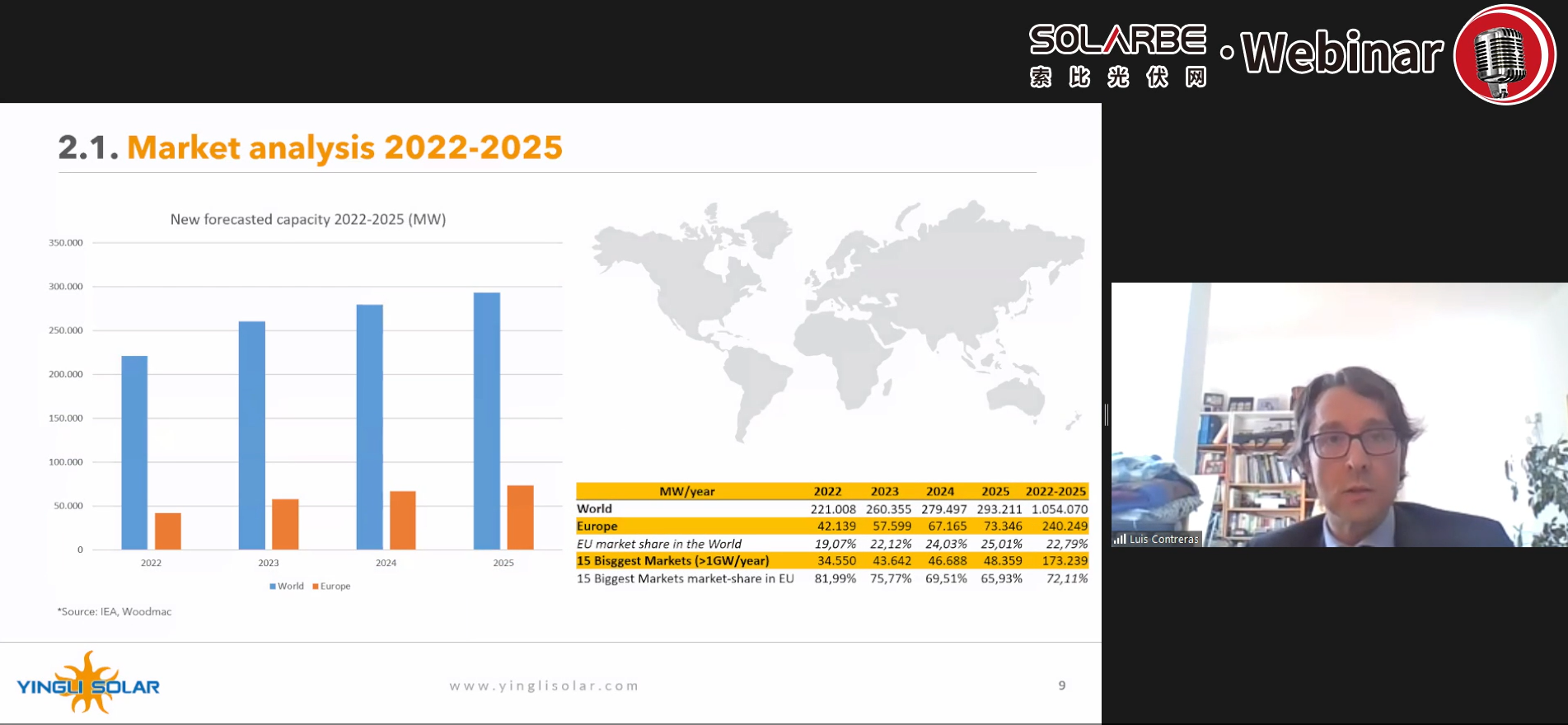

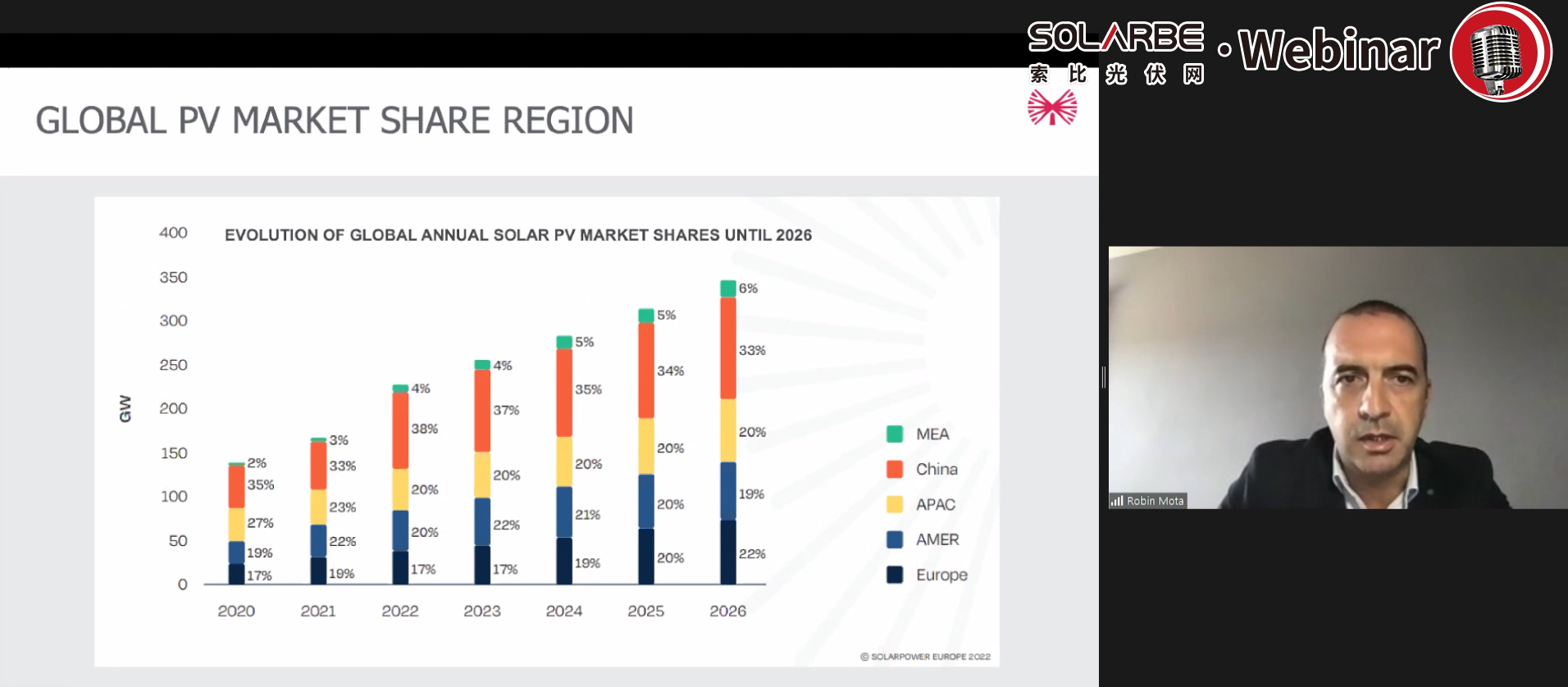

Mr. Luis Contreras started the session by talking about the challenges in EU solar market faced by module manufacturer. He elaborated on the market analysis and specific segmentation from 2022-2025 showing Europe’s huge potentials in the coming years, as it could cover about 240 GW, almost a quarter of the global installation by 2025, with Germany, Spain, France, Netherlands and Poland as leading roles in this area. Utility scale will represent 50% market share and residential (<10 KW) to large commercial (5 MW) will also take almost 50%.

A screenshot of Mr. Luis Contreras' presentation

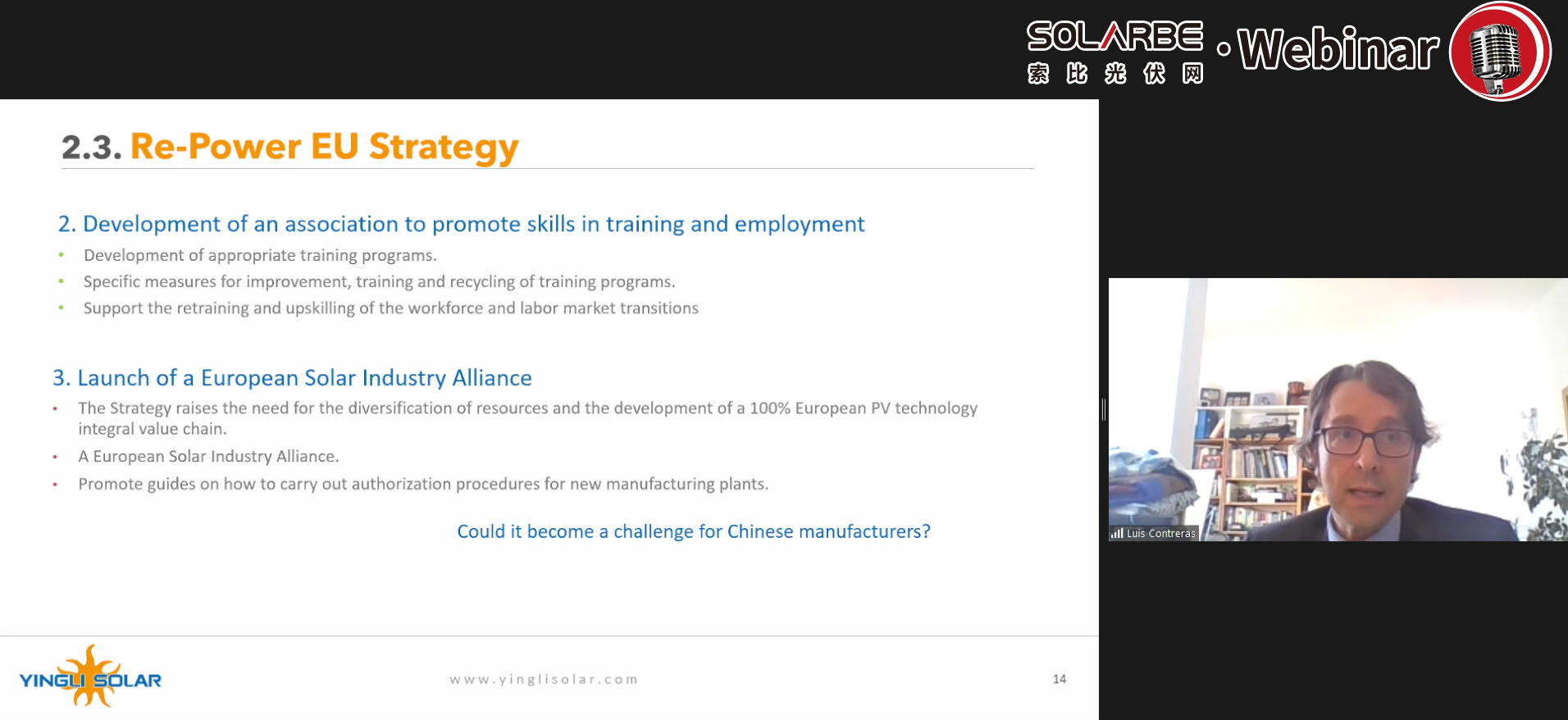

He then illustrated some measures imposed by EU, such as the launch of European Solar Industry Alliance, and promoting guides on how to carry out authorization procedures for new manufacturing plants, which he assumed could be a challenge for Chinese manufacturers if EU wanted to guarantee the whole value chain must be 100% local. During the sharing, Contreras focused more on the challenges under this seemingly promising market. He said that competition has become even fierce day by day in terms of prices, logistics and economic factors, and Yingli Solar would focus more on the cost control and more advanced technology application. He believed that enterprises are now in a very complex situation since the economy is unstable due to various reasons, which directly affect the final prices of their products.

A screenshot of Mr. Luis Contreras' presentation

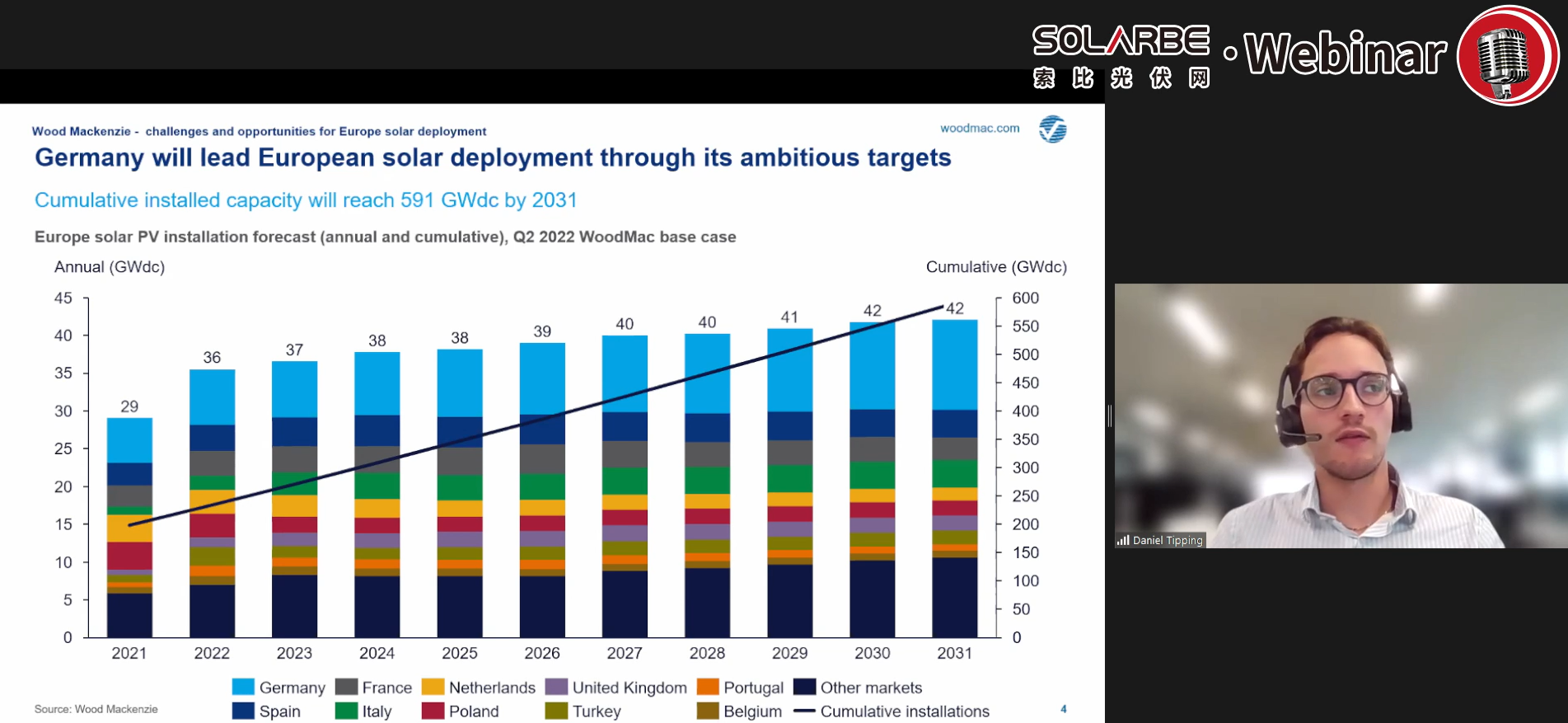

Daniel Tipping of Wood Mackenzie, introduced some high-level trends and highlights of European solar deployment. He started his presentation by showing Europe’s spiking power prices after the start of the Russia-Ukraine war, which could promote EU’s transition to clean energy, especially solar. Germany will lead the way and guide Europe’s cumulative installation to 591 GWdc by 2031 through expended auctions and increasing feed-in tariffs incentives to rooftop solar, though it’s a debatable issue now, according to Tipping.

A screenshot of Mr. Tipping's presentation

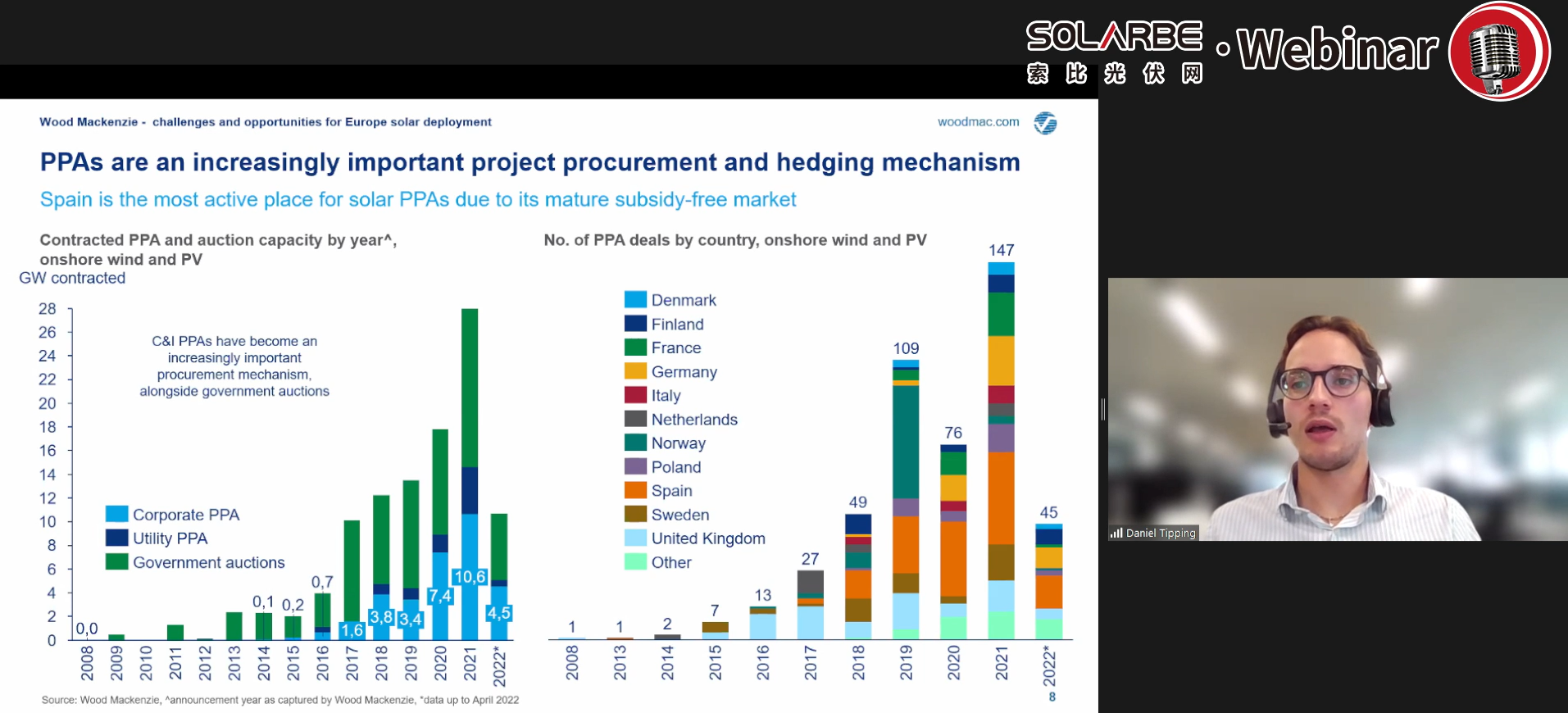

Tipping pointed out that solar is set to be one of the largest power sources in Europe by 2050, and its coverage will be particular high in those countries with ambitious power targets. This will lead to significant impacts on developers due to price cannibalization, and it’s likely to result in more located storage solutions to maintain an adequate rate of return for projects. PPAs are also an increasing important project procurement and hedging mechanism, with Spain by far being the most significant and main PPA hub in Europe for they have a relatively mature subsidiary market, attractive resources and cooperative banks. It is expected that Germany and France could pick up greater volumes in the years ahead because they have strong industrial bases, Tipping added. He also revealed the serious unavailable grid injection capacity problem in Netherlands, which have severely postponed the grid connection of project to up to five years in some cases, and such bottlenecks could last until 2029.

A screenshot of Mr. Tipping's presentation

Followed Tipping, Robin N Mota Dawson of Ideematec Spain gave a thorough introduction of Ideematec and revealed their ambition in participating in the opportunities discovery in Europe and further coverage of global market share. Dawson believed that efforts should be made by politicians to ease the current situation and erase these hurdles in solar deployment, and the current biggest problem lies on the development of regional solar supply chain.

A screenshot of Mr. Dawson's presentation

These representatives also shared their views in terms of prices and other relevant issues during the panel.

Solarbe: Polysilicon price in China has been climbing since this year, which has affected the whole solar value chain, how much will it affect Europe's clean energy transition?

Tipping: The inflation is definitely a serious problems in the supply chain, and it will impose huge impact on future capex costs and LCOE as well if it carries on, which can directly lead to project delays and cancellation. Solar materials make up around 40% of the embedded cost of solar modules and the prices have been skyrocketing, so it’s very crucial and difficult to Europe to build its own solar supply chain if they want to meet key capabilities to realize the goal.

Solarbe: What's the module price trend in Europe?

Contreras: Things like inflation, interest ratio, exchange ratio etc are all rising, and they’re likely to remain current trends for some time. So we have been working to be more efficient in energy consumption and working factories such as improving our working process and update production as much as possible to reduce the cost of production.

Solarbe: Have you observed any impact for tracker manufacturer brought by prices hikes in commodity?

Dawson: The current price situation maybe the craziest because we’ve seen 40%-50% increase in raw materials in a few weeks after the Russian-Ukraine conflict, as well as the shortage problem. So we’ve moved most of our production from Ukraine to Turkey, and the tracker price has increased by 30% within few weeks. Thus we have to find more stable supply from other places, maybe China or India, whilst the logistic costs are sky high. So in our case, there is 2-2.5 cents increase in the trackers.

Solarbe: How much effort Europe needs to take to decrease their dependence on Russian gas and Chinese solar products?

Tipping: There is a lot has to be done to achieve that because we’ve seen that Europe imported over 70% of the module needs in 2020 and EU plans to decrease the percentage by a lot. The bottleneck is specifically in wafer, cell and module manufacturing capacity at the moment. Although Germany has a relatively large polysilicon production capacity, most of it is exported back to China, which is a wasted opportunity for wafer, cell and module production. In the end, if the EU wants to reach their targets, it will be crucial to set up these local supply chains."

Solarbe: As a Chinese module manufacturer, does Yingli Solar see more opportunities or challenges in current or future European solar market since EU wants to build its own supply chain?

Contreras: Sure, we see more demand, and there are many factors affecting our business, but we also noticed some opportunities for us to penetrate deeper in more areas on the basis of us making sure the stable supply of some elements such as raw materials and our cooperation with logistic partners. Europe is going to be a key market in the coming years and we’ll give more focus on it.

Solarbe: How Ideematec prepared for the challenges ahead?

Dawson: Actually it’s not easy. We need to increase our resources internally including qualification, quality control and logistics so to become a supplier with more share, and take more risks in the raw material supply and take our position in this market. It’s also important for us to choose the right time and be cautious when making decisions and be compatible with the market when seeing these ups and downs.