In 2021, Latin America’s PV capacity additions increased by 44%, totaling 9.6 GW, with cumulative capacity of more than 30 GW. The region’s solar market has grown more than 40 times since 2015. Projections suggest that by 2026, it could grow by up to 30.8 GW per year. In this incredible success story, one country emerges as a rising star: Brazil.

Solarbe has invited Luis Contreras, Managing Director of Yingli Solar Europe and Latin America, Angel Cancino, Research Analyst from IHS Markit, S&P Global, and Michael Liu, Solar Analyst from Solarbe Consulting to join a virtual session on the topic of global view on solar market and shed light on Brazilian solar market.

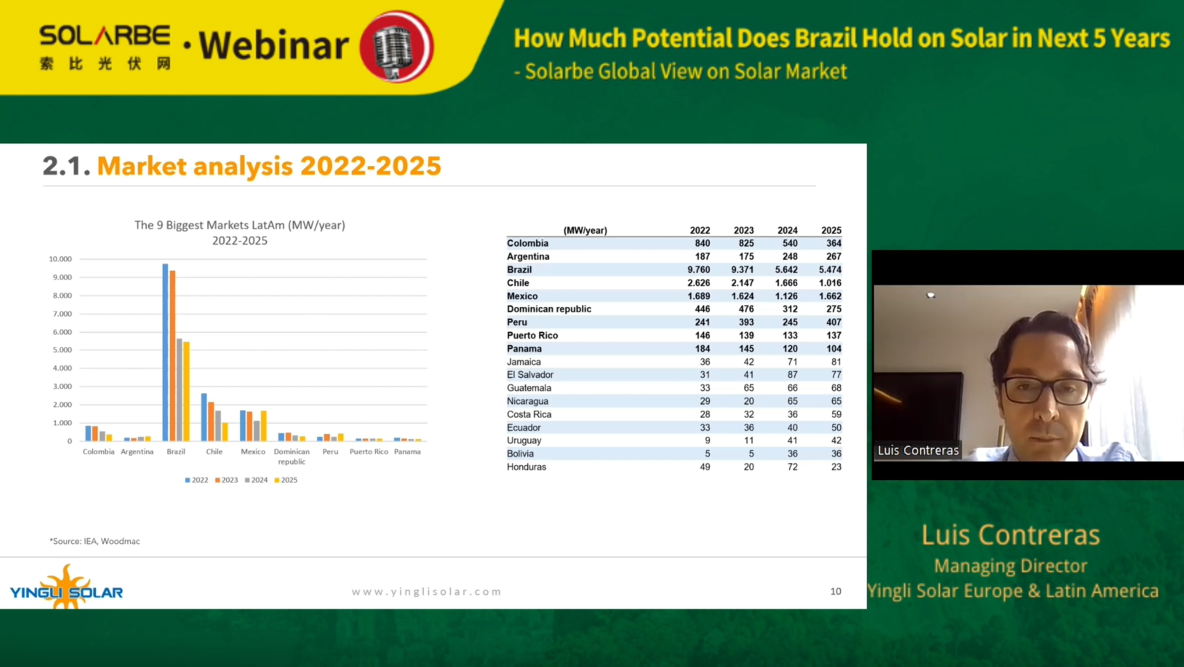

Luis Contreras opened the session by talking about the challenges and opportunities in Brazilian solar market. He saw a positive scenario in local market and it’s full of potentials. The country is with forecasted 3.3% energy demand forecast, standing up at the top place among the nine biggest markets in Latin America. Currently, utility scale represents 43% market share and distributive covers the rest.

A screenshot of Luis Contreras’s presentation

Contreras also elaborated on the challenges hindering Brazil solar from progressing. From Yingli’s perspective, supply chain bottleneck, logistics cost, and interest ratio are all impacting Brazilian solar installation, and they will work in deep synergies and partnership in the supply chain players and logistics services.

A screenshot of Luis Contreras’s presentation

Angel Cancino, Research Analyst from IHS Markit of S&P Global has given a thorough introduction of Brazil solar PV market. According to Cancino, Brazil is one of the most important markets in Latin America, and solar energy continues to grow in Brazil, to the point that it has just surpassed the historical mark of 16 GW of total operating power, with distributed generation market as the main driver.

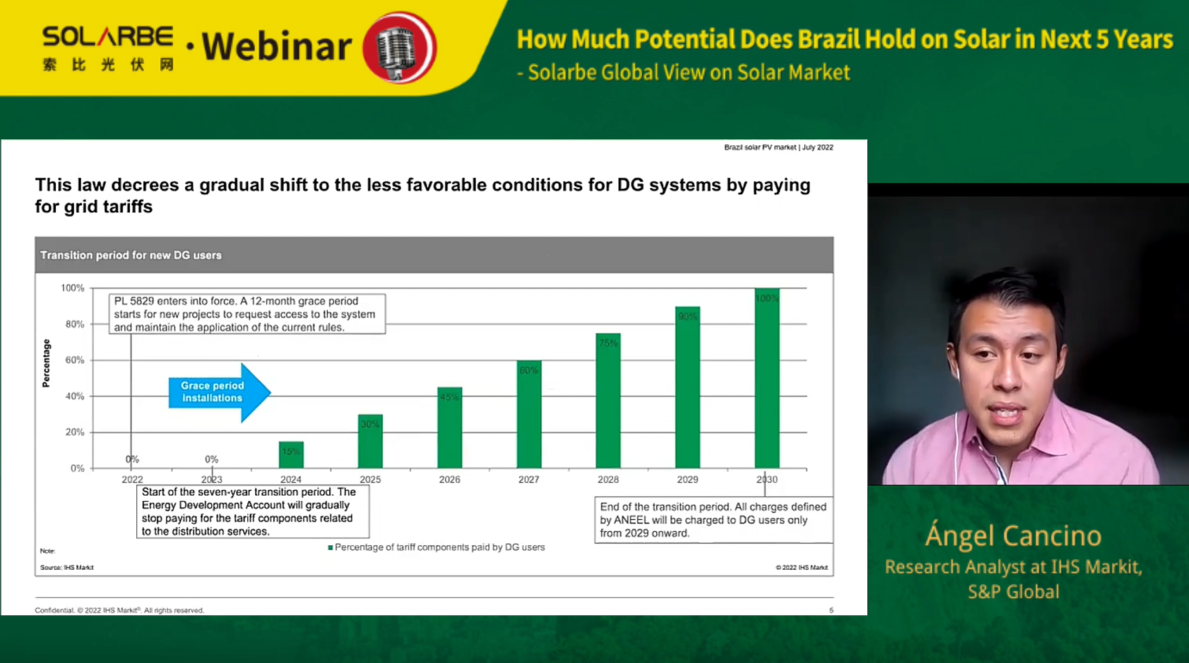

A screenshot of Angel Cancino’s presentation

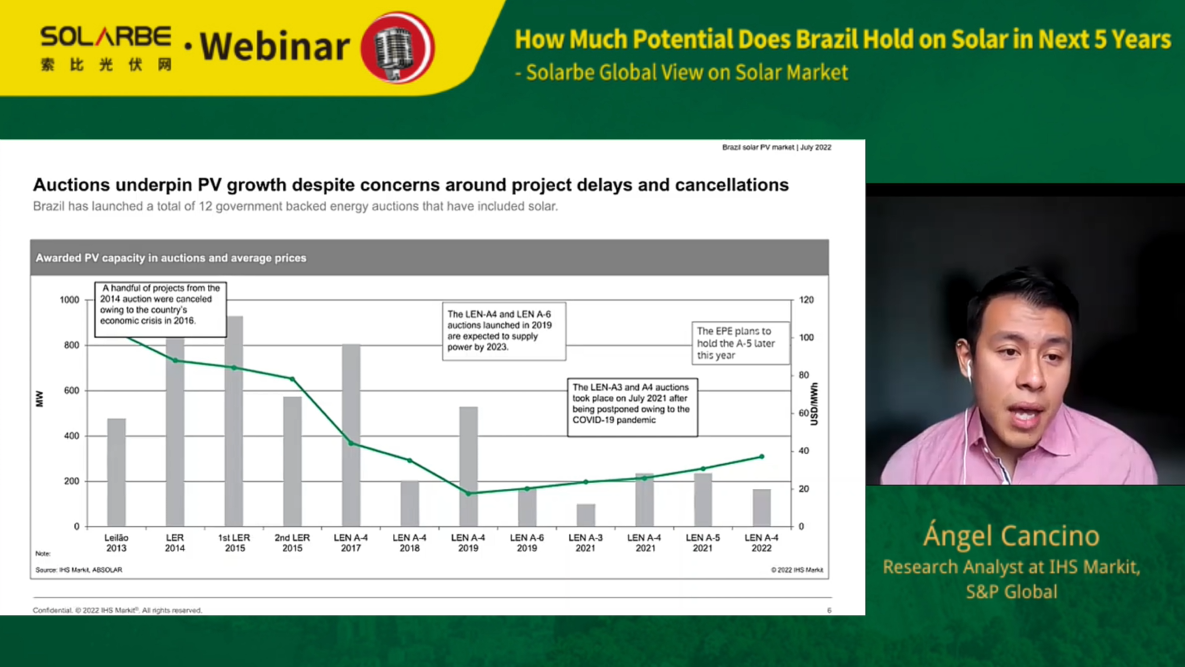

Distributed generation photovoltaics have been the major deployment and exploded in the past few years and will last in the coming years, thanks to the Law 5829, which aims to remove some of the grid access privileges held by distributed generation generators for new systems, said Cancino, and IHS Markit expects an annual installation peak for this scenario in 2023, with up to 10 GW before the expiration of the Law. Actions underpin PV growth despite concerns around projects delays and cancellations. Among 12 auctions Brazilian government has launched since 2013, solar are all included, while a handful of projects from the 2014 auctions were canceled due to the country’s economic crisis in 2016, and some more were left stranded for other reasons.

A screenshot of Angel Cancino’s presentation

Brazil also has a large PV pipeline that is projected to move forward between 2022-2023, totaling 15 GW. New additions will add up to 12 GW, with 7.7 GW for commercial and 4.6 GW for utility, and the momentum is expected to increase in the following years due to its net-metering policy. However, factors including high system prices, increasing module prices, high maritime freight rates, fewer access to Tier 1 modules and lack of manpower are all limiting the forecast installation rate.

Michael Liu, Solar Analyst from Solarbe Consulting also gave a brief introduction from geographical aspect. Liu said that though with abundant solar radiation, the country’s power supply reliability is subpar, and the drought in recent years has also deteriorated the situation. The good point is that Brazilian government has issued relevant policies to support local solar development and great progress has been seen in the year of 2021, when the country added 5.66 GW in total and cumulative installed capacity exceeded 16 GW by the end of May 2022.

A screenshot of Michael Liu’s presentation

Liu added that local solar installation will be further supported by soaring electricity price, cancelation of import tariffs on solar products, net-metering policy and gradual withdrawal of transmission and distribution subsidies, and Brazil will unleash more demand for residential storage equipment.