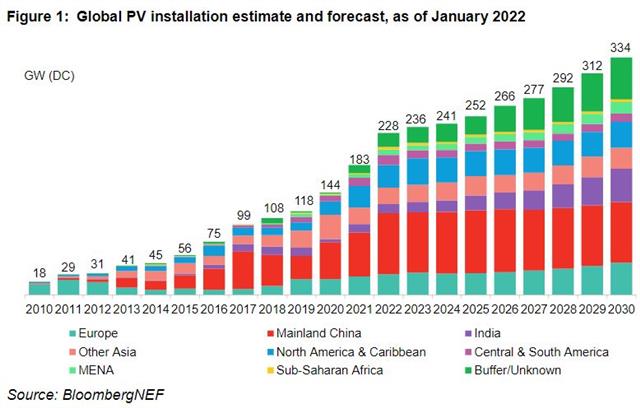

Bloomberg New Energy Finance (BNEF) has predicted that 2022 will be the first year in which more than 200GW of solar will be installed.

The consulting firm estimated solar installations to reach 228 GW in 2022 in its mid scenario with range from 204 to 252 GW. It is a significant uptick from the firm’s expectation in November 2020, where the highest scenario for the year was 206 GW.

Solar module prices

Solar module prices will fall to 25 U.S. cents per Watt in 1H 2022, and 1-2 cents per Watt lower in 2H 2022, says BNEF.

Polysilicon production has been the bottleneck in 2021. Combined with strong demand, it has pushed module prices as high as 27.8 U.S. cents per Watt for standard monocrystalline silicon, monofacial modules using 166mm cells.

The firm expects 39% more polysilicon production in 2022 than in 2021, with total supply enough to make nearly 300GW of silicon solar products, thanks to new capacity ramping up and factory debottlenecking.

This will ease the supply crunch. Already, the silicon price has fallen back from $37/kg in October to $32/kg in the last month of 2021. BNEF expects that to further decline to $20-25/kg in 2H 2022.

Improved efficiency, and modules made of larger wafers with side length of 182mm and 210mm becoming a mainstream product, are estimated to allow another 1 U.S. cents/W reduction in module prices. Module prices may drop by 11-15% to 23-24 U.S. cents/W in 2H 2022, added BNEF.

Installed utility-scale solar-and-storage will double

BloombergNEF’s database currently tracks 278 utility-scale PV-and-storage plants fully commissioned, with total PV capacity of 12.5GW and battery capacity of 2.7GW / 7.7GWh.

The largest markets this year will be China and the U.S. The U.S. is already a well-established solar-and-storage market. In China, 20 provinces now require or encourage new-build renewables to pair with energy storage.

China’s residential and C&I rooftop solar sector will drive new build to a record 81-92GW in 2022

Since the middle of 2021, China’s central authorities have encouraged local governments to coordinate available rooftops and build small-scale PV in bulk. The bulk development pattern will assist the growth of the residential sector, particularly in rural areas, with the support of local governments.

State-owned enterprises have entered the small-scale PV market to lead the bulk development, while private enterprises with experience act as EPC or construction subcontractors. BloombergNEF expects China’s residential PV installation in 2022 to exceed a record 20GW.

In the commercial and industrial (C&I) sector, the power crunch in September 2021 allowed authorities to increase power prices by up to 20%, in order to pass on some of the coal fuel costs to users. The higher power price will make C&I rooftop PV more profitable and motivate power intensity users to install rooftop PV systems.

China has set a total energy consumption cap for each province every year to control carbon emissions, leading to power rationing and production curbs in parts of the country in 2021.

At present, renewable energy is also counted with in total energy consumption. However, according to the latest state council meeting, onsite renewable power may not be counted in the total consumption quota for the users next year, meaning that installing rooftop PV could prevent production suspension.

BloombergNEF expects that higher power prices and energy consumption quota exemption policy will both drive C&I rooftop PV uptake, and that new C&I installation will probably exceed 10GW in 2022.