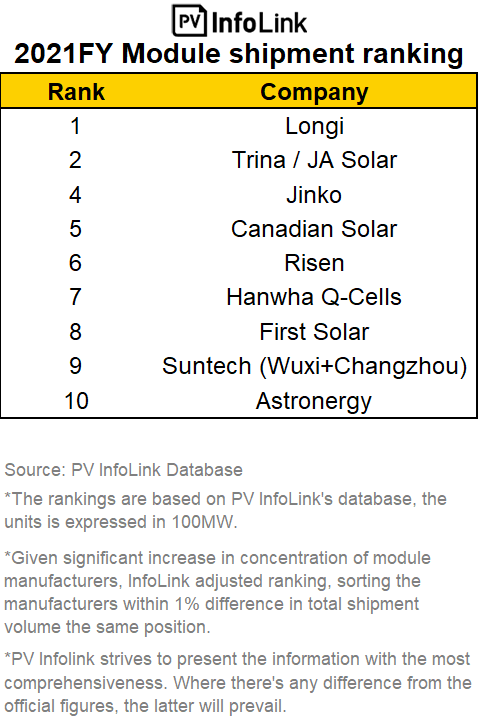

Solar industry giant Longi Solar secured the champion on global shipment volume in 2021, Trina Solar and JA Solar were tied for the second place, followed by Jinko Solar and Canadian Solar, according to 2021 Module Shipment Ranking release by industry consulting body PV InfoLink.

The data revealed that module shipment is further concentrated to the leading enterprises. In 2020, the shipment of the top 10 global module manufacturers covered 84%, which exceeded 90% in 2021. Whilst the situation of cell is different. Due to active expansion of vertically integrated manufacturers, the shipment of professional cell manufacturers has also increased, but the growth rate is obviously lower than that in 2020.

The proportion of large-size products is increasing rapidly, which is reflected in both cells and modules. InfoLink’s data show that large-size products account for about 40% of the total shipments of the top 10 module manufacturers (excluding First Solar) in the whole year, and has become the current mainstream format. The proportion of large-size cells shipped in the whole year has also exceeded 53%.

Source: InfoLink

Consolidated advantages of vertically integrated manufacturers

In the past few years, the industry chain has been highlighting the feature of higher concentration of upstream than that of downstream links. However, the situation reversed in 2021, and the concentration of module links increased significantly. The top 10 manufacturers of module shipments in 2021 are the same as those in 2020. Those that didn’t make the top-10 list shipped an average volume of 3-4 GW, an increasingly widened gap between manufacturers.

2021 saw high consolidation of manufacturers in the module segment. Vertically integrated companies, which enjoy advantages in costs, capability, and overseas channels, put Tier-2 and 3 module makers under pressure. InfoLink’s calculation suggests the top-10 shipped a total of more than 160 GW of modules, dominating more than 90% of 172.6 GW of demand, far exceeded the previous 70-80%.

Seen from the proportion of overseas shipments, the advantages of vertically integrated manufacturers in the distribution channel is prominent. In the second half of 2021, the overseas shipment of top 10 Chinese module manufacturers reached 70%.

At present, there are also some small-scale module manufacturers such as EGing PV and Haitai Solar. The consolidation trend is bound to make it more difficult for such companies to survive. Some manufacturers are expected to have a large number of cell and module expansion plans; based on the shortage of raw materials, small and medium-sized module manufacturers still have to face the test of market share, sluggish operation and profit.

For cells, specifically, in the second half of 2021, new cell production lines of vertically integrated manufacturers continued to go online, the self-sufficiency rate continued to increase, the market share of professional cell manufacturers was gradually divided, and the growth rate began to shrink. The shipment of the top five professional cell plants increased by 81% in 2020, while the annual growth of shipment decreased to 36% in 2021.

Increased proportion of large-size products

Since the launch of 210mm large-size silicon wafers by Zhonghuan Semiconductor, Longi Solar and other manufacturers have also formed a camp to support 182mm products. Although debates never ceased between 182 and 210, these changes have promoted the development of the industry to large-size formats, and the proportion of 158mm and 166mm, which were originally the mainstream, has decreased rapidly in the past year. The share of large format modules represented around 40% of total shipments by the top-10 (excluding First Solar), said InfoLink.

JA Solar previously revealed that by the end of 2021, the company’s module capacity was about 40 GW, and 182mm accounted for over 70%. In 2021, Trina Solar had a planned module capacity of 50 GW, of which 210mm accounts for over 70%. The cumulative shipment of Trina Solar 210mm modules exceeded 16 GW, ranking first among all large-size cell module enterprises.