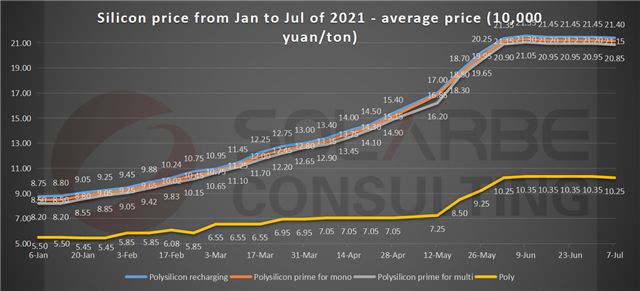

Silicon

The price of silicon materials this week continued to fall. The average price of recharging materials dropped to RMB 209,500 yuan/ton, down 2.10% month on month; the average price of polysilicon prime for mono was RMB 207,500 yuan/ton, down 1.89% month on month; and RMB 205,000 yuan/ton for polysilicon prime for multi, down 1.68% month on month.

According to the report of Chinese Silicon Industry, there is a big price difference between long-term orders and scattered orders signed this week. The highest price difference of polysilicon orders of the same enterprise has reached RMB 6 yuan/kg. Solarbe Consulting believes that this is the good sign from the industry feedback on future expectation, and the downstream expected lower price of silicon.

In terms of supply, the incremental release of the resumption of maintenance enterprises in July brought about a small increase in silicon production. The supply exceeded demand compared with the demand of silicon wafer with lower operating rate, and the silicon price showed a downward trend in the short term.

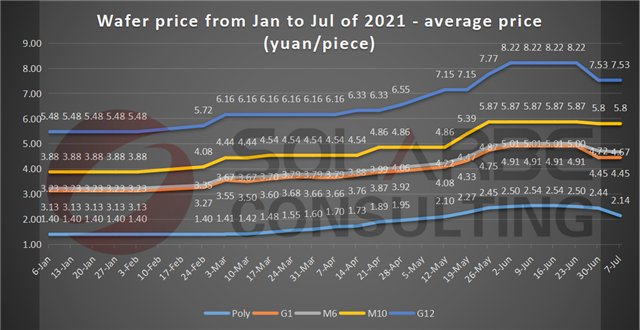

Wafer

The price of downstream cells has been continuously reduced, leading serious pressure to wafers, and the decline of raw material prices also makes some enterprises adjust their quotations. The transaction range of wafer price is large, which will fluctuate in the short term, and is difficult to stabilize. The operating rate remained unchanged.

The price of polysilicon wafers decreased significantly, with an average price of RMB 1.98 yuan/piece, a month on month decrease of 7.49%, with further narrowed demand. Seen from the bidding situation in the first half of 2021 in China, only 0.1 GW polycrystalline is needed in the bidding of 24.238 GW modules. India, the main polysilicon market, has also reduced its demand due to the pandemic and other reasons. It is expected that the prices will further decline.

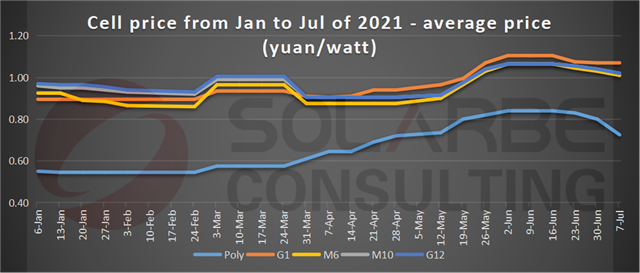

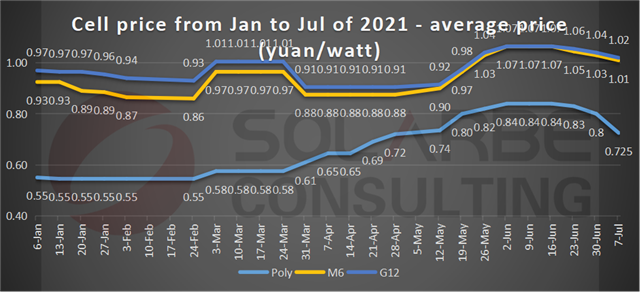

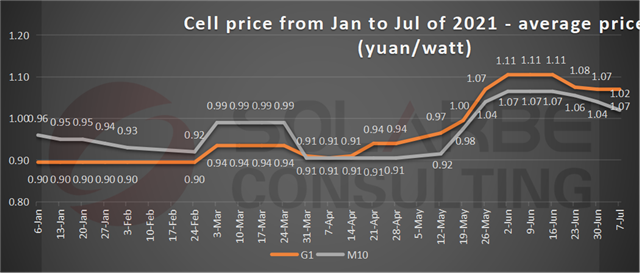

Cell

After the two leading companies lowered their prices to gain more market share, the second and third tier enterprises began to carry out low price strategies in order to obtain orders. As a result, the price of cell continued to decline this week.

Interestingly to mention that for M6 cell, the market is in a wait-and-see state, and the price goes down quickly. Due to the LCOE advantage of large-size modules, they are very popular in the bidding in the first half of the year, and the market share was further improved.

Module

Module prices were flat with last week’s. The continuous decrease in the price of cells further reduces the cost pressure on the modules. As large-scale projects are purchased in the form of bidding, according to the current bidding situation, most of them are still carrying out previous orders, and the continuous decrease in the price of silicon brings about mark down of cells, with possibility of further reduction.

About Solarbe Consulting

Relying on Solarbe, the authoritative media in the photovoltaic industry, Solarbe Consulting focuses on data and industry research. It provides photovoltaic enterprises with market data, enterprise consulting, price trend, enterprise analysis, market research, customized report and other services, helping enterprises make correct decisions in sales, production, expansion and decision-making.