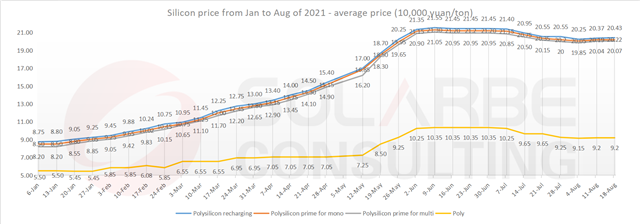

Silicon

In the case of increasing terminal demand, the operating rate of silicon wafer enterprises further increased, thus driving the demand for silicon materials. The price of silicon materials continued to rise slightly this week. From the perspective of enterprise transaction price, such price of first-line manufacturers is on the high side, which is basically higher than the average price of this week, with a price difference of about RMB 1,000 yuan/ton. The transaction prices of other enterprises are mostly below the average price, with price difference as high as 15,000 yuan/ton. Most of them are determined by the supply and brand of first and second tier enterprises.

The recovery of demand is transmitted to all links of the industrial chain, which not only promotes the operating rate of each link, but also supports the increase of price. If the price rise exceeds the terminal users’ affordability, it will inhibit the growth of demand and make the industrial chain price tend to be stable in fluctuation this year.

This week, the average price of monocrystalline recharging material was RMB 204,300 yuan/ton, up 0.27% month on month, 202,200 yuan/ton for polysilicon prime for mono, up 0.12% month on month, and 200,700 yuan/ton for polysilicon prime for multi, up 0.15% month on month. The average price of polycrystalline materials was 92,000 yuan/ton, same as last week.

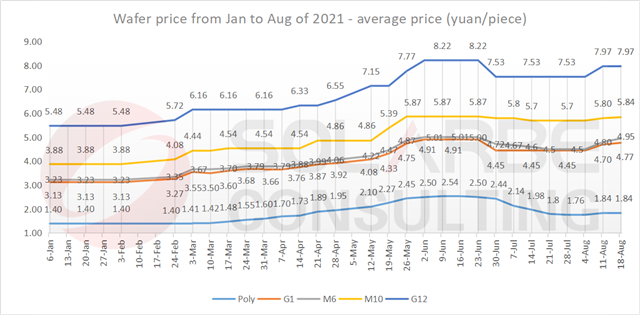

Wafer

The price of silicon wafer continued to rise this week, with M6 taking the lead.

As a result of demand pull, the price of M6 changes greatly due to its special elimination shock period. At the end of June, when the price of the whole industrial chain decreased, M6 decreased the most. At that time, the market’s attitude towards M6 was unclear, which showed partial panic under the rapid promotion of super large size. Thus the manufacturers only wanted to clear the inventory as soon as possible, resulting in weak supply, but there was still a certain demand for M6, so the current price increase occurred.

According to the recent bidding information, the mainstream trend of super large size in the market is still advancing rapidly, mainly are 530W+ modules. Some believed that M6 will continue to occupy a certain position in residential because of its size, cost and other advantages. Solarbe Consulting believes that in terms of the essence of the industry, LCOE would be the final focus. If the products of M10 and G12 are more mature, M6 will no longer have advantages.

The average price of G1 wafer was RMB 4.77 yuan/piece, up 1.49% month on month, 4.95 yuan/piece for M6, up 3.13% month on month, 5.84 yuan/piece for M10, up 0.69% month on month, and 7.97 yuan/piece for G12, without change. The average price of polysilicon wafer was RMB 1.84 yuan/piece, remained same.

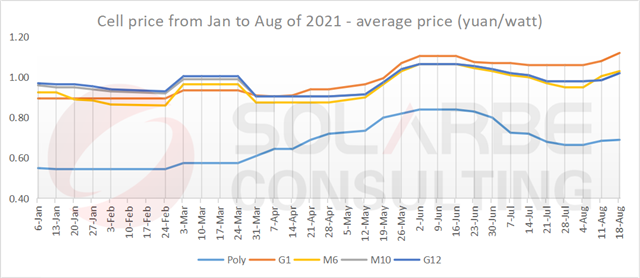

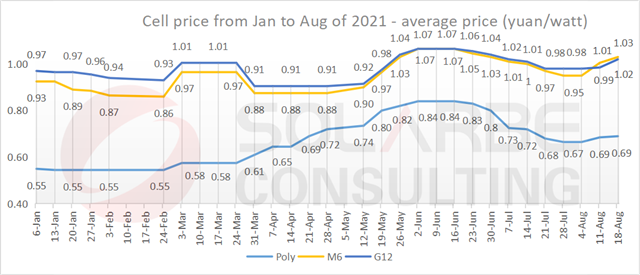

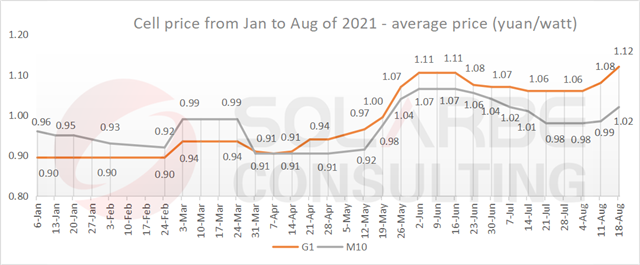

Cell

The cell price continued to rise this week.

The average price of G1 cell was RMB 1.12 yuan/W, up 3.70% month on month, 1.03 yuan/W for M6, up 2.49% month on month, 1.02 yuan/W for M10, up 3.55% month on month, and 1.02 yuan/W for G12, up 3.55% month on month. The average price of polysilicon cell was RMB 0.69 yuan/W, remained same.

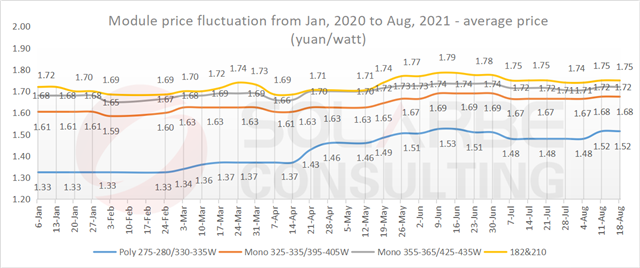

Module

After the module price rose last week, it remained stable this week, but the price in upstream supply chain continued to rise, as well as some auxiliary materials including glass and EVA. According to Solarbe Consulting, some module manufacturers intend to raise the price, but the current price – about RMB 1.80 yuan/W, is the acceptance upper limit for terminal users. There is great resistance and difficulty to realize that.

The average price of 182-210mm monocrystalline modules this week was RMB 1.75 yuan/W; 1.72 yuan/W for 355-365/425-435W; and 1.68 yuan/W for 325-335/395-405W. The average price of polycrystalline 275-280/330-335W modules was RMB 1.52 yuan/W.

About Solarbe Consulting

Relying on Solarbe, the authoritative media in the photovoltaic industry, Solarbe Consulting focuses on data and industry research. It provides photovoltaic enterprises with market data, enterprise consulting, price trend, enterprise analysis, market research, customized report and other services, helping enterprises make correct decisions in sales, production, expansion and decision-making.