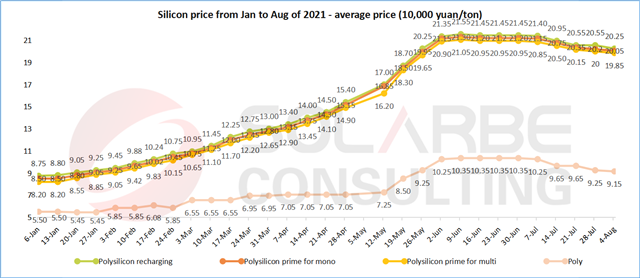

Silicon

The downward range of silicon material price narrowed this week.

From the demand side, due to the setting of the installation target of some central and state-owned enterprises, the installation demand has begun to increase slowly, the order volume of each link has recovered, and the demand for silicon material has increased. Before the downstream make moves, the decline of silicon material price will be further narrowed and gradually stabilized.

From the supply side, the price of industrial silicon has risen for three consecutive weeks since July 21. As the raw material of silicon, the rise of industrial silicon price may have a certain impact on the price of silicon material, accelerating the narrowing of the price decline of silicon material.

This week, the average price of polysilicon recharging was RMB 202,500 yuan/ton, a month on month decrease of 1.46%, 200,500 yuan/ton for polysilicon prime for mono, a month on month decrease of 0.74%, and 198,500 yuan/ton for polysilicon prime for multi, a month on month decrease of 0.75%. The average price of polycrystalline silicon was RMB 91,500 yuan/ton, down 1.08% month on month.

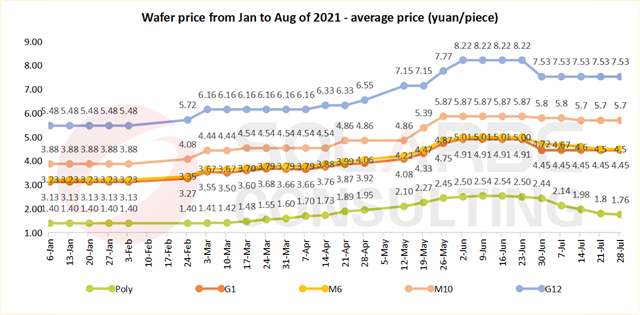

Wafer

Due to the gradual recovery of demand, silicon wafer enterprises also gradually resume procurement, and the operating rate is on the rise. According to the analysis on the current situation, compared with the demand in the second half of the year, the silicon material is in short supply. Even if some imported silicon can be used as a supplement, there is little possibility of silicon material price reduction without enterprise intervention. That is, the cost of silicon wafer will not change greatly, but the price of silicon wafer is still possible to be reduced. After the production capacity of Shangji Automation, JYT Corporation and Gaojing comes up, the market share of Longi and Zhonghuan Semiconductor will decline, the current silicon wafer market pattern will be changed, the pricing power will be dispersed, and the competition at wafer will be more intense, together with price reduction.

In terms of monocrystalline silicon wafer this week, the average price of G12 is RMB 7.53 yuan/piece, 5.7 yuan/piece for M10, 4.5 yuan/piece for M6, and 4.45 yuan/piece for G1. The average price of polycrystalline wafer is RMB 1.76 yuan/piece.

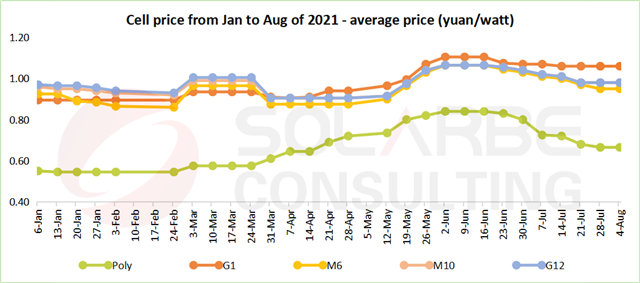

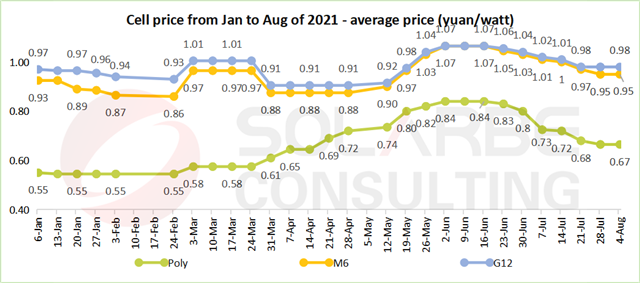

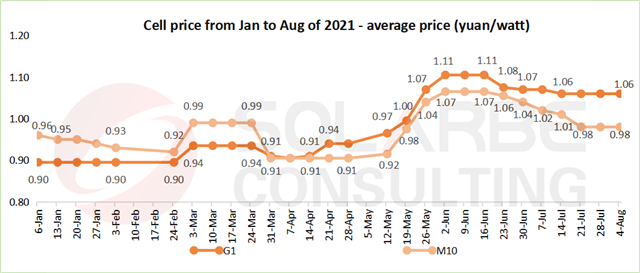

Cell

Similarly, affected by the gradual recovery of demand, the operating rate of cells has gradually increased. In July, while the price of silicon wafer remained stable, the price of cell decreased slowly in order to clear the inventory. When the demand showed a recovery trend in August, the cell price began to maintain stable. With the further increase of demand, the cell manufacturer may raise the price, leading a new round of price game in modules.

The average price of G12 and M10 is RMB 0.98 yuan/W, 1.06 yuan/W for G1, and 0.95 yuan/W for M6. The average price of polycrystalline cell is RMB 0.67 yuan/W.

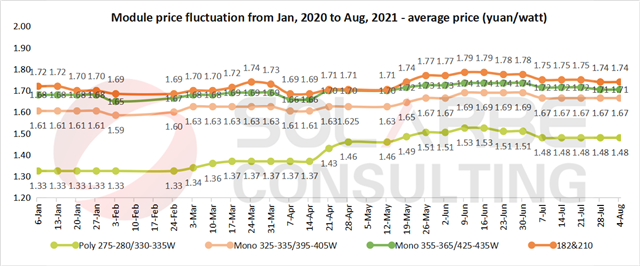

Module

With the increasing demand, the operating rate of the module recovered first, but the module price will not rise again. It is difficult for the terminal owners to accept higher prices. Besides, the increase of module price will affect the enthusiasm of installation and have a negative impact on the newly installed capacity this year. As for whether the terminal owners will put pressure on the modules before finishing the installation target, whether the module price will decline and how much the decline can reach, it depends on the specific supply and demand.

About Solarbe Consulting

Relying on Solarbe, the authoritative media in the photovoltaic industry, Solarbe Consulting focuses on data and industry research. It provides photovoltaic enterprises with market data, enterprise consulting, price trend, enterprise analysis, market research, customized report and other services, helping enterprises make correct decisions in sales, production, expansion and decision-making.