Chinese solar silicon maker GCL Poly Energy Holding Limited officially resumed trading today on Hong Kong Exchanges and Clearing Limited (HKEX) after seven-months suspension. The stock price hit HKD 3.62 dollars, an increase of 82.83%.

According to the 2021 semi-annual report of the company, it realized revenue of RMB 8.779 billion yuan and net profit attributable to the parent of about RMB 2.407 billion yuan. At present, the monthly output of polysilicon materials has exceeded 9,000 tons, ranking first in the world.

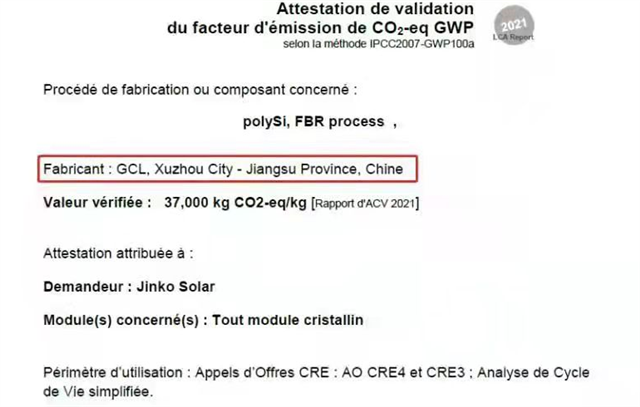

The company’s representative stated that Jiangsu Zhongneng Silicon Industry, a subsidiary of GCL Poly, applied for the French carbon footprint certification for granular silicon products in July 2021, and obtained the FBR granular silicon product carbon footprint certificate issued by the French National Energy Agency at the end of October.

The carbon footprint value of every kilogram of granular silicon produced is only 37.000 kg of carbon dioxide equivalent, which greatly refreshes the previous record of 57.559 kilograms, set by German Wacker.

The French National Energy Agency is one of the most authoritative certification bodies in the world, and the assessment method adopts the Life Cycle Assessment (LCA) – assessment of environmental impacts related to product life “cradle to grave”. Obtaining the certification of this agency directly reflects the emission advantages of granular silicon.

When carbon emission rights trading is fully implemented in the future, granular silicon products that meet the trend of “dual control” of energy and consumption will have more market initiative, effectively solving the pain points of high energy consumption and large carbon emissions in the front end of the photovoltaic industry chain in the past polysilicon links, to realize the industrial transformation of “low energy consumption and high efficiency” at the raw material production end of the photovoltaic industry.

In the performance warning issued in March this year, GCL Poly announced a new strategic layout, which included in-depth focus on the main business of silicon materials, and focus on the granular silicon business. Not long ago, in the company’s 2020 annual report, the company once again reiterated this strategic layout, saying focusing on the main business of silicon materials is a major strategic layout made by the company after careful research and judgment on industrial rotation and market cycles.

GCL Poly has been expanding its granular silicon production capacity on a large scale in the past year. The company has announced plans to build three 100,000-ton silicon bases in Xuzhou, Leshan, and Baotou. It is reported that in the second half of this year, Xuzhou has completed the construction of an additional 20,000 tons of granular silicon production capacity and will be put into production. It is expected that the production capacity of 54,000 tons of granular silicon will be released next year. At the same time, the Leshan Phase I Granular Silicon Project is rapidly advancing, and the relevant work of the Baotou Granular Silicon Project has been fully carried out.

On the golden track of the photovoltaic industry chain, clean energy supply is the key, and the silicon-based material revolution to drive low-price photovoltaic grids is the key. As a next-generation silicon-based new material, FBR granular silicon, with its multiple advantages of low cost, high efficiency and excellent carbon footprint, will have a profound impact on the future development of the photovoltaic industry and the clean energy revolution.

In the past period of time, GCL Poly has been vigorously adjusting its capital structure and continuously reducing its assets and liabilities significantly. Up to now, GCL New Energy, a subsidiary of GCL Poly, has cumulatively sold more than 6.6 GW of photovoltaic power plant assets and successfully realized the light asset transformation. The liquidity situation has been significantly improved, and it has completely returned to the new track of benign and healthy development.

At present, as the pace of scientific and technological research and development accelerates, the company’s market performance has become more stable and better, the debt structure has been optimized day by day, the leverage ratio is scientifically and rationally controlled, and the debt liquidity risk has been effectively controlled.

In sharp contrast to the decline in debt, GCL Poly has geometrically doubled its investment in research and development. The 2021 semi-annual report showed that such expenses has reached RMB 479 million yuan during the reporting period, a year-on-year increase of over 106%. .

In addition, GCL Poly vigorously promotes a partnership system, establishes an equity incentive system for technical personnel and other key elites, and adopts a series of strict measures to protect independent intellectual property rights.