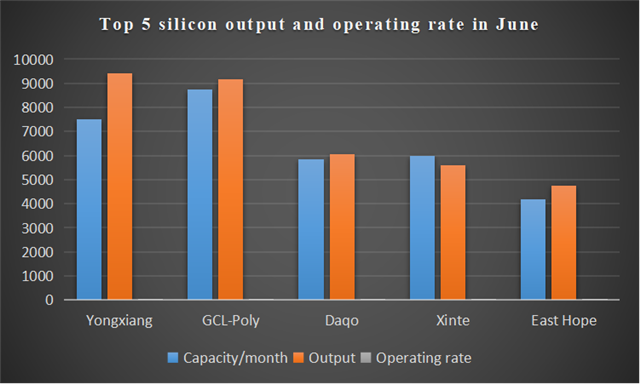

Silicon

Following the record high in April 2020, the silicon output reached a new high in June 2021, with an output of 40,000 tons (about 14 GW), up 3.5% month on month, mainly due to the capacity optimization and maintenance of Yongxiang. The total output of top five enterprises has reached 35,000 tons, accounting for 87.2%, and the comprehensive operating rate reached 108.2%.

It is expected that in the second half of the year, silicon will remain in short supply. From 2017 to 2020, the fluctuation of supply and demand in the industry led to the shutdown of most silicon plants and almost no new production capacity was added, and the release of new production capacity in 2021 was limited. Some enterprises continued to be in full production in the first half of the year, and there will be maintenance plan in the second half of the year.

Source: Chinese Silicon Industry, Solarbe Consulting

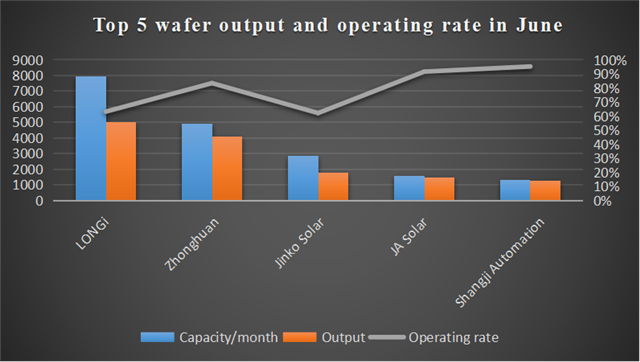

Wafer

In June 2021, the silicon wafer output was 17.73 GW, down 5% month on month. Longi, Zhonghuan Semiconductor, Jinko Solar, JA Solar and Shangji Automation swept the top 5 in terms of output, with a total of 13.6 GW, accounting for 76.6% and a comprehensive operating rate of 79.1%.

The release of new production capacity intensified the elimination of small and medium-sized enterprises. The 37 GW new wafer production capacity of JYT Corporation, Gaojing and Hongyuan was completed and put into operation at the end of June; another 20 GW of Shuangliang Group was in construction in Baotou; and it is expected that more than 50 GW will be released by the end of this year, thus the capacity will exceed the demand. The entry of new enterprises will aggravate the elimination of small and medium-sized enterprises, and the situation of duopoly may change.

Source: Solarbe Consulting

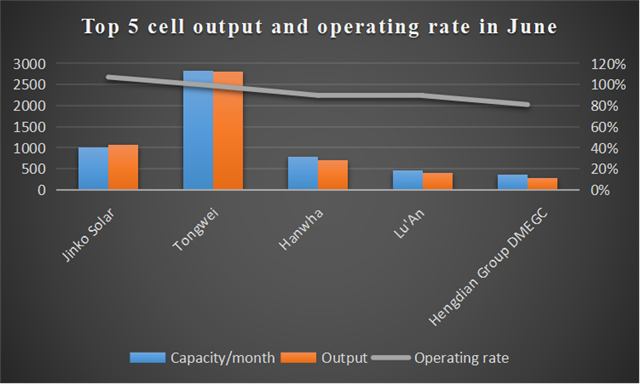

Cell

In June 2021, the cell output was 15.24 GW, down 2.7% month on month. Due to the continuous rise in the price of wafers, the vertically integrated module enterprises stopped purchasing, the small and medium-sized ones also delayed purchasing, which led to intensified operating pressure of cell enterprises, resulting in the continuous decline of cell output for five consecutive months.

In June, Tongwei, Longji, JA Solar, Aikosolar and Trina Solar ranked top 5 for cell output, with a total of 8.2 GW, accounting for 54.1%, together with comprehensive operating rate of 75%. On the whole, the comprehensive operating rate of vertical integration enterprises was 81%, and the operating rate of cell enterprises continues to decline.

Source: Solarbe Consulting

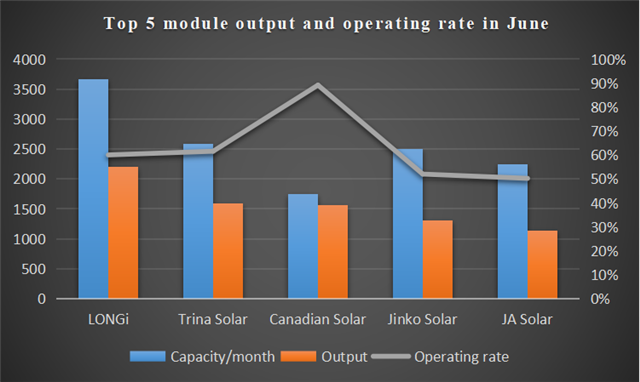

Module

The module output reached its lowest in June of the year, with a total of 14.57 GW, a month on month decrease of 8.2%. The price fluctuation has affected downstream terminals to stock, and the inventory of module manufacturers led to the decrease of enterprise operation rate.

In June, Longji, Trina Solar, Canadian Solar, Jinko Solar and JA Solar ranked top 5 for module output, with a total of 7.9 GW, accounting for 53.4%, with the comprehensive operating rate of 62.6%. According to the forecast of 60 GW installation in the whole year, only 9.91 GW were installed from January to may this year, accounting for 16.5%. It is expected that there will an installation rush in the second half of this year, and the operating rate of module production will increase.

Source: Solarbe Consulting

About Solarbe Consulting

Relying on Solarbe, the authoritative media in the photovoltaic industry, Solarbe Consulting focuses on data and industry research. It provides photovoltaic enterprises with market data, enterprise consulting, price trend, enterprise analysis, market research, customized report and other services, helping enterprises make correct decisions in sales, production, expansion and decision-making.