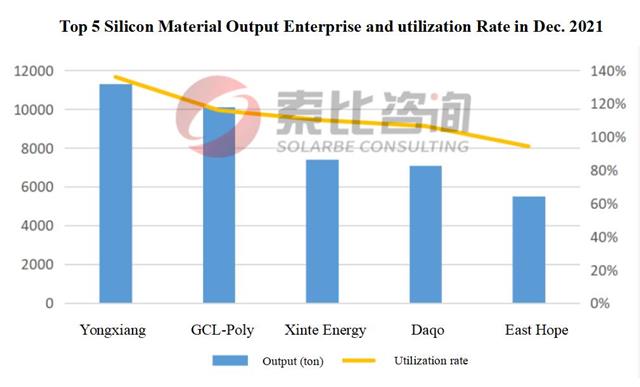

Silicon material

There are 12 polysilicon enterprises remain in production in December 2021, which brought domestic output to a new high. The turnover was bleak for two consecutive weeks, resulting in a small amount of inventory backlog in some silicon material enterprises. In December, the domestic polysilicon output was 48,800 tons (about 19.28 GW), an increase of 15.9% MoM.

Yongxiang, GCL, Xinte Energy, Daqo and East Hope rank among the top five regarding output, with a total of 41,400 tons, accounting for 84.8% and the comprehensive utilization rate was 112.6%, and Solarbe Consulting expects silicon production to rise slightly in January.

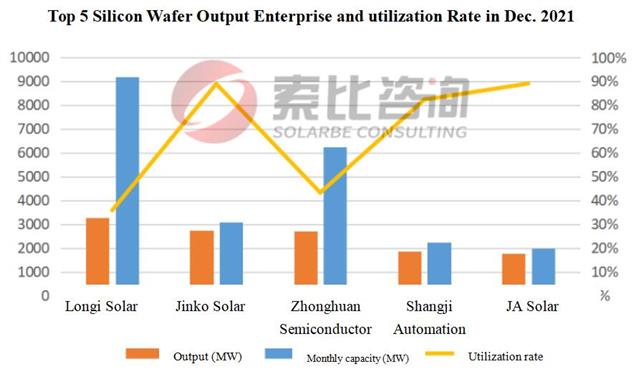

Wafer

In December 2021, the operating rates of the two leading silicon wafer enterprises increased to 50% and 60%, but the terminal demand was lower than expected. The domestic silicon wafer output in this period was 17.85 GW, down 8.6% MoM.

Longi Solar, Jinko Solar, Zhonghuan Semiconductor, Shangji Automation and JA Solar rank among the top five regarding to wafer output, with a total of 12.35 GW, accounting for 69.19%, which is expected to pick up slightly in January and the comprehensive utilization rate was 67.81%.

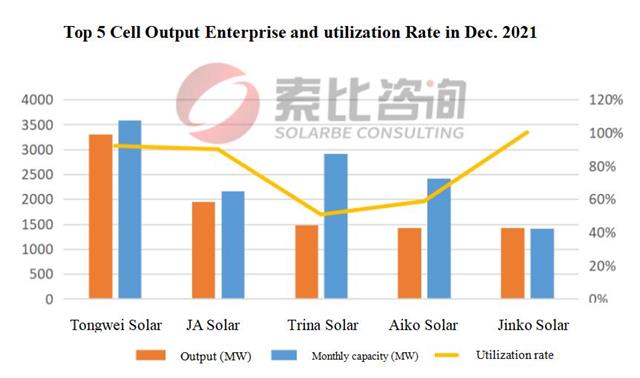

Cell

The output of cell enterprises in last December was basically the same as that of the previous month, with a total of 17.83 GW, an increase of 0.22% MoM. Tongwei Solar, JA Solar, Trina Solar, Aiko Solar and Jinko Solar rank among the top five, with a total of 9.57 GW, accounting for 53.67%, and the comprehensive utilization rate was 78.37%, such rate of vertically integrated enterprises was 70.6%, and that of mainstream cell enterprises was 81.36%.

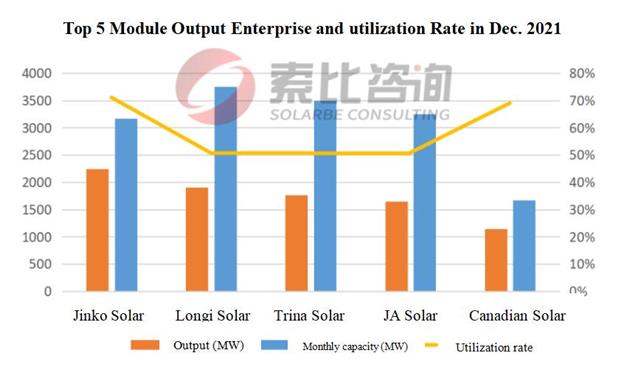

Module

The terminal demand increased slightly during this period, as well as the module output, with a total of 16 GW, up 2.23% MoM.

Jinko Solar, Longi Solar, Trina Solar, JA Solar and Canadian Solar rank among the top five regarding module output during the period, with a total of 8.72 GW, accounting for 54.5%, and the comprehensive operating rate was 58.41%. The centralized procurement bidding of domestic enterprises in 2022 has been started one after another, which may lead a slight rise in the demand and price of modules.