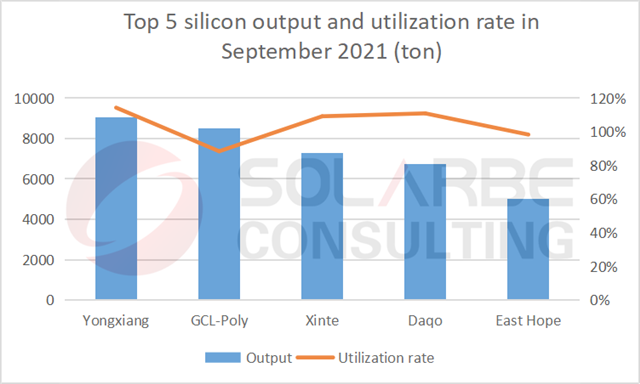

Silicon material

In September 2021, twelve domestic silicon material enterprises were in production. Affected by the imbalance of supply and demand structure and national dual control of energy and consumption, the price of raw material silica fume soared; Silicon enterprises in Jiangsu, Yunnan and Inner Mongolia were forced to stop and reduce production.

At the same time, the output of silicon producer Juguang Silicon Company and other enterprises was gradually released, so that the output in September was basically the same as that in August, a total of 42,800 tons (about 16.92 GW), an increase of 0.2% month on month. The outputs of Yongxiang, GCL, Xinte, Daqo and East Hope ranked among the top five, a total of 36,600 tons, accounting for 85.5% and the comprehensive utilization rate was 103%.

Solarbe Consulting expects a slight decrease in silicon production in October. From the supply side, due to the influence of dual control of energy and consumption, the production of silicon materials in Yunnan is limited or the purchase of raw materials of silicon materials is limited, and the supply of silicon materials in the market will be slightly tight.

In October, according to the production and operation plans of silicon material enterprises, some enterprises gradually recovered and conducted maintenance. In the early stage, with the continuous increase of the operating rate of downstream silicon wafers and the advent of the peak season of photovoltaic demand at the end of the year, the demand remained unchanged in October, supporting the rise of silicon price.

Data source: Silicon Branch of China Nonferrous Metals Industry Association, Solarbe Consulting

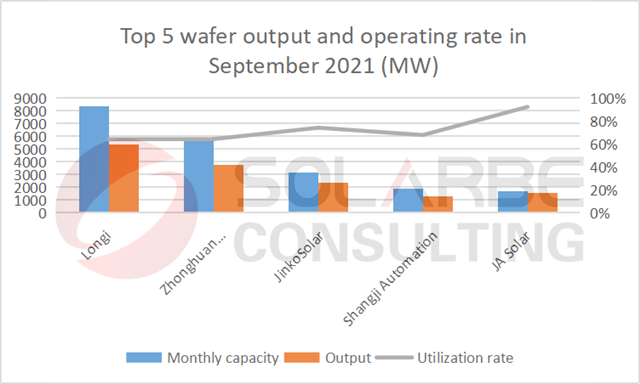

Wafer

In September, the terminal demand at home and abroad has improved, the operating rate of battery and wafer enterprises remained high, the demand for silicon wafer orders continued to increase, the operating rate of silicon wafer enterprises improved significantly, and the shipment volume continued to increase. The domestic silicon wafer output was 18.55 GW, with a month on month increase of 7.97%. The outputs of Longi, Zhonghuan Semiconductor, JinkoSolar, Shangji Automation and JA Solar ranked among the top five, a total of 14.29 GW, accounting for 77.02%, and the comprehensive utilization rate was 72.58%.

Silicon wafer production is expected to decline in October. From the supply side, the supply of silicon material is tight. The output of silicon wafer is limited by silicon material, and the raw material of silicon material (silicon powder) is limited, and the influence of electricity and energy consumption is reduced. From the demand side, silicon wafer leading enterprises have successively increased their silicon wafer quotations, battery enterprises are under heavy pressure, and their purchase desire is reduced.

Data source: Solarbe Consulting

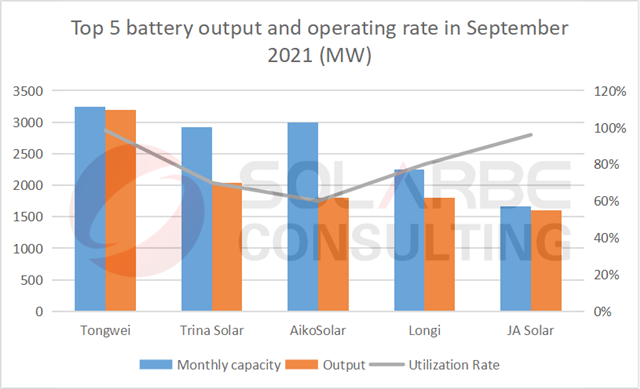

Battery

In September 2021, manufacturers with silicon wafer supply in battery enterprises basically reached full production, and the output was basically the same as that in August, with a total output of 17.69 GW, an increase of 0.48% month on month. The outputs of Tongwei, Trina Solar, AikoSolar, Longi and JA Solar ranked among the top five, a total of 10.44 GW, accounting for 59.0%, and the comprehensive utilization rate was 80.89%.

Battery production is expected to decline in October due to various reasons.

Some battery factories are forced to stop production and reduce production due

to power restriction. It is understood that during the first week of October,

battery enterprises collectively reduced the operating rate, which decreased by

about 47.33%. The full-size operating rate remained at about 50%, such rate of

182mm decreased significantly, and 166mm basically shut down. The orders signed

by module enterprises in the early stage will fall into serious losses, and the

top five module enterprises jointly called for guiding enterprises to avoid the

installation rush at the end of the year and promoting the orderly construction

of domestic power station projects.![]()

Data source: Solarbe Consulting

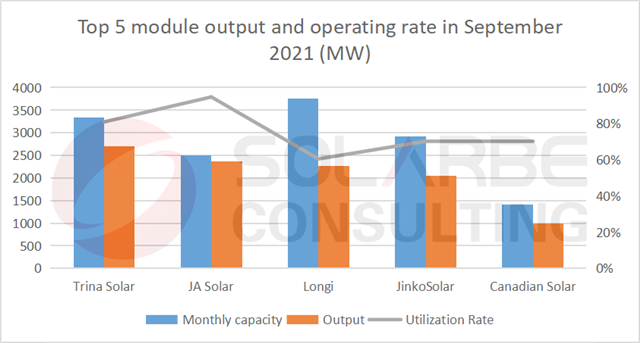

Module

In September 2021, faced with the rising price of upstream silicon wafer batteries and the increase of commodity prices, module enterprises were under heavy pressure and adopted the reduction of operating rate to ensure profit; On the other hand, the terminal market has limited acceptance of module prices and reduced purchase desire. Domestic module output was 16.82 GW, down 3.47% month on month. The outputs of Trina Solar, JA Solar, Longi, JinkoSolar and Canadian Solar ranked among the top five, a total of 10.39 GW, accounting for 61.75%, and the comprehensive operating rate was 75.44%.

Module production is expected to decline in October, and the current capacity reaching rate of leading enterprises will not exceed 70%; raw material production capacity and supply are in a shortage, though the demand in the terminal market is high, affected by the module price, the purchasers would barely make the deal.

Data source: Solarbe Consulting