Solar photovoltaic (PV) products are crucial for the adjustment of energy structure and the green transformation of industries. Currently, the United States has built high walls of protectionism by imposing multiple trade restrictions and continuously increasing tariff barriers on imported PV products. On the other hand, it implemented exclusive and discriminatory industrial policies through legislation such as the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA), and subsidized its own PV industry in a large scale which violated the multilateral trade rules and severely distorted the market operations of the global supply chain of PV industry and impeded international cooperation in areas such as climate change.

I.The U.S. Inflation Reduction Act provides unprecedented subsidies for PV manufacturing and installation

The Inflation Reduction Act, introduced in 2022, offers subsidies of an unprecedented $369 billion to support investments and production in the clean energy sector, including domestic photovoltaic products, aiming to reconstruct the PV industry chain.

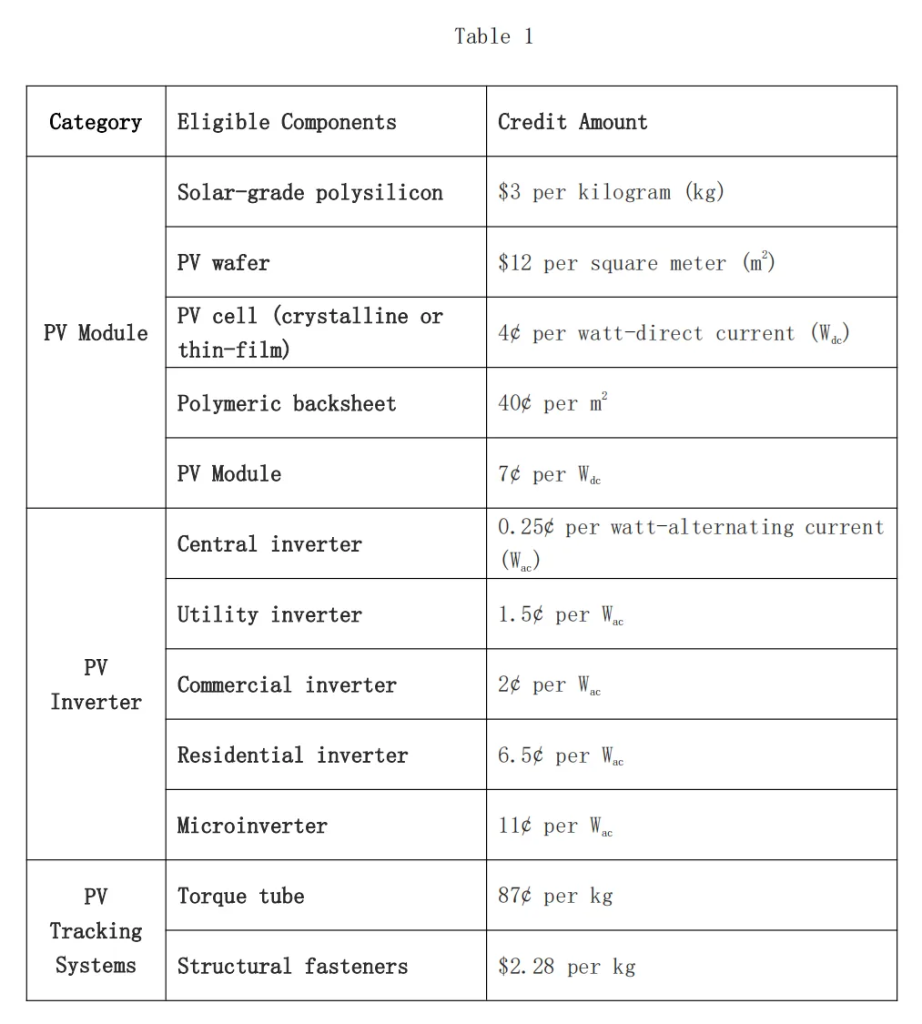

i.In terms of PV manufacturing, the U.S. federal government provides tax credits to PV companies based on their investment amount or product specifications, which amount to $10 billion, covering projects in the clean energy manufacturing sector, including PV, with credit rates reaching up to 30% of the investment. Photovoltaic raw materials, cells, modules, and supporting products are all eligible for tax credits, with specific standards listed in Table 1.

Benefiting from substantial government subsidies, American PV companies are able to continuously expand their manufacturing in the country while facing revenue losses. Take First Solar as an example. According to its 2023 financial report, the company achieved a net profit of $830.777 million, with approximately $659.745 million labeled as government grants receivable, accounting for 79.39% of its profit. This part of income did not exist in 2021 and 2022. In the first quarter of 2024, the company reported a net profit of $236.616 million, with government grant amounting to $281.889 million. Without the subsidies, First Solar would have incurred a net loss of $45.27 million during that period. This significant turnaround was entirely due to the huge amount of government subsidies and tax credit. Meanwhile, the company announced plans to expand its PV module factory in Ohio and to build new factories in Alabama and Louisiana with $2.4 billion of investment, aiming to quadruple its current capacity.

In addition to module manufacturers, companies of raw material and accessories in the industry have also received plenty of subsidies. According to the U.S. Department of Energy, the Internal Revenue Service has allocated approximately $4 billion in tax credits for more than 100 projects developed in 35 states. Among the voluntarily disclosed PV projects were Highland Materials, which received $255.6 million for producing solar-grade polysilicon in Tennessee, and SolarCycle, which received $64 million for producing solar glass in Georgia.

Additionally, to support the implementation of the production tax credit policy under the IRA, the U.S. Department of Energy’s Loan Programs Office has provided a $1.45 billion loan guarantee to domestic crystalline silicon photovoltaic manufacturer Qcells, which supports its PV industry chain project in Cartersville, Georgia. Once completed, the project will produce silicon ingots, wafers, cells, and finished PV modules, making it the largest silicon ingot and wafer plant in the country, addressing a critical gap in its domestic PV supply chain.

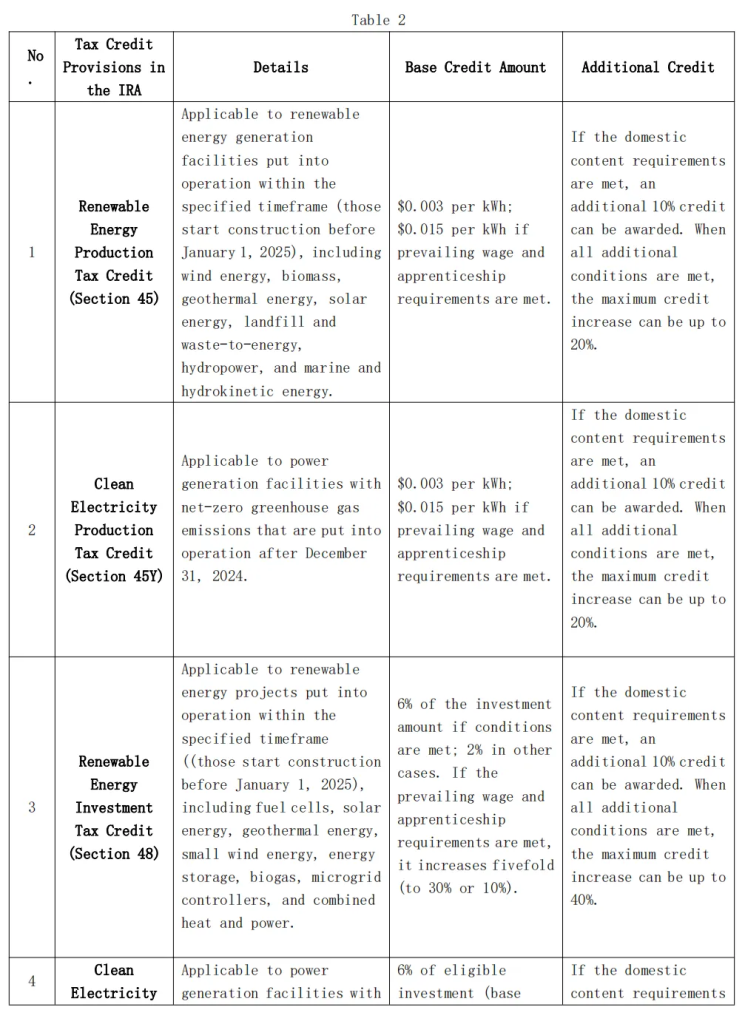

ii. For PV power generation, the Inflation Reduction Act provides four main types of tax credits for domestic projects, as illustrated in Table 2. Notably, for each of these four subsidy policies, projects that meet the requirements in domestic content will receive an additional tax credit. Domestic content refers to using a certain proportion of steel, iron, or manufactured goods, mined, produced, or manufactured in the United States, which may violate the WTO’s national treatment principle.

iii. For residential PV applications, on June 28, 2023, the Biden administration announced the Solar for All initiative, which is a key component of the $27 billion Greenhouse Gas Reduction Fund under the IRA. This initiative provides $7 billion for residential rooftop and community distributed solar projects, reducing the cost of PV installation and usage.II.The U.S. provides substantial grants and subsidies for the research and development of photovoltaic technologies

The U.S. Department of Energy’s Solar Energy Technologies Office (SETO) establishes annual funding programs to provide direct support for PV research and development, and demonstration projects, funded by the Department of Energy and the IIJA. On May 16, 2024, the Department of Energy announced a $71 million investment, including $16 million from the IIJA, to fund the The Silicon Solar Manufacturing and Dual-Use Photovoltaics Incubator Program ($27 million) and the Advancing U.S. Thin-Film Solar Photovoltaics Funding Program ($44 million), aiming to close gaps in PV supply chain manufacturing capabilities.

i.Funding for PV R&D and Demonstration Projects

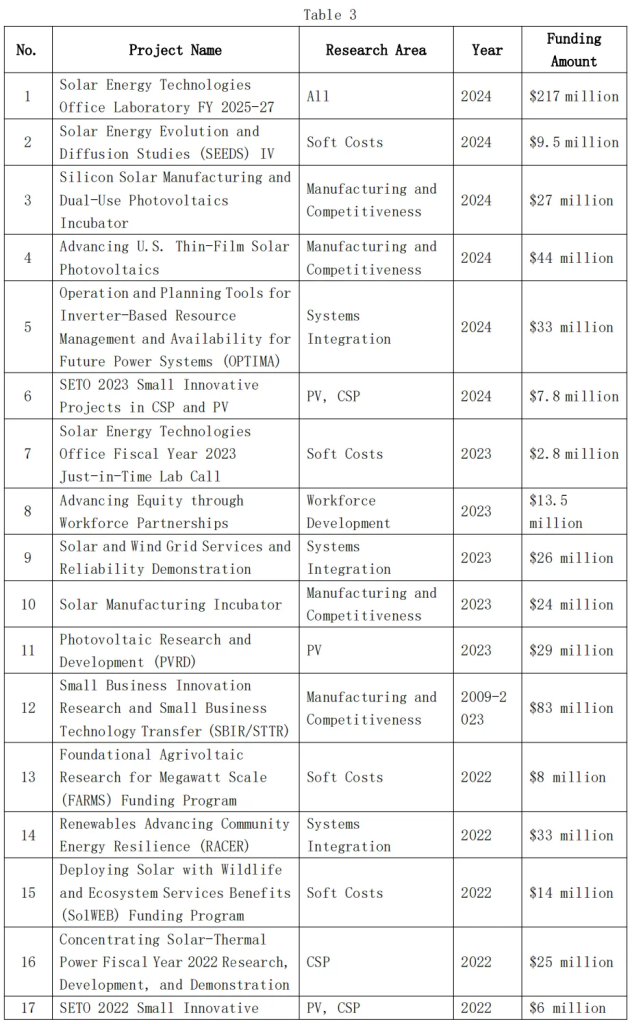

According to SETO of the U.S. Department of Energy, since 2022, 19 PV research and development, and demonstration project funding programs have been implemented, totaling $615.6 million, with details listed in Table 3.

ii.Silicon Solar Manufacturing and Dual-Use Photovoltaics Incubator

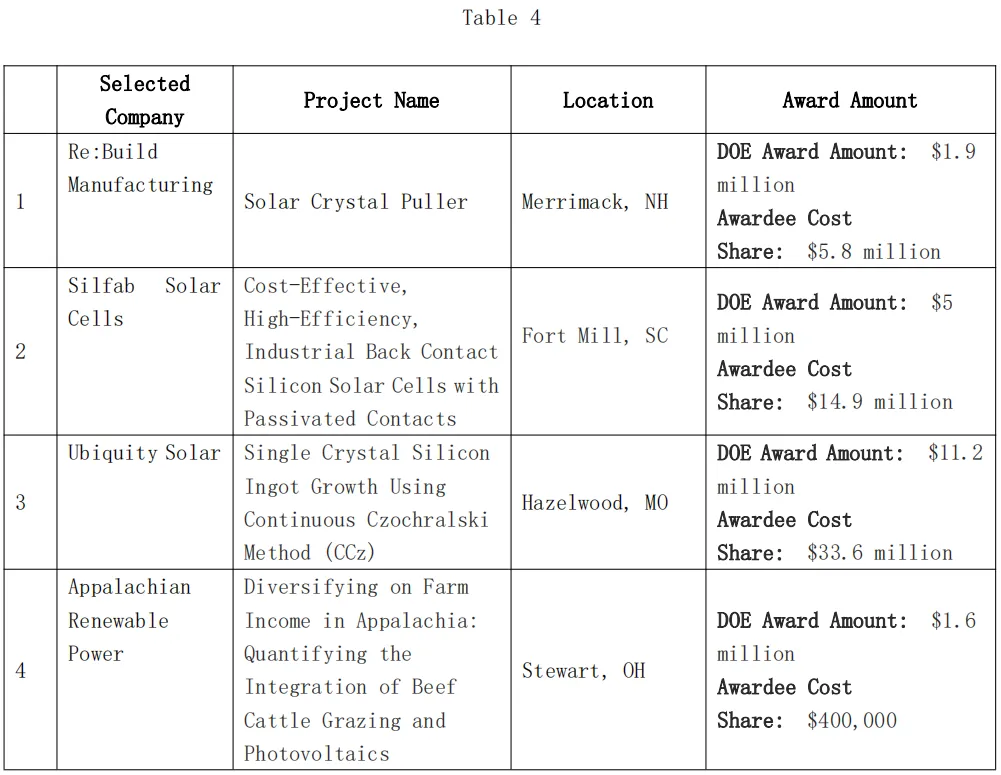

The Silicon Solar Manufacturing and Dual-Use Photovoltaics Incubator Program (No. 3 in Table 3) deploys $27 million to support the development of the next-generation solar technologies. On May 16, 2024, SETO announced 10 selected projects as listed in Table 4:

iii. Advancing the U.S. Thin-Film Solar Photovoltaics Funding Program

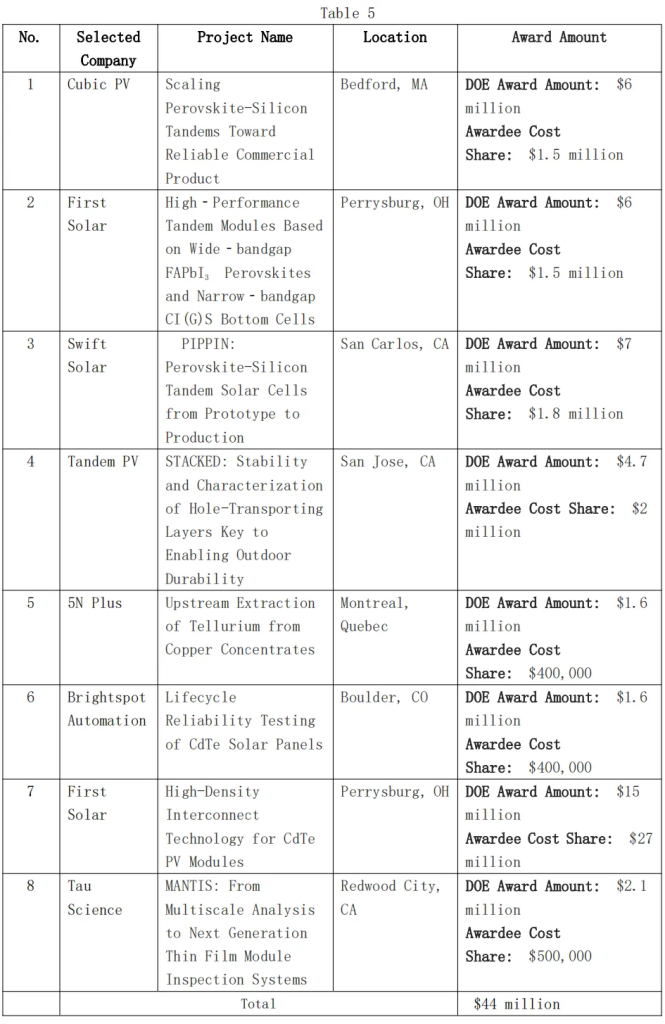

The Advancing U.S. Thin-Film Solar Photovoltaics Funding Program (No. 4 in Table 3) has allocated $44 million for local research, development, and demonstration projects on two major thin-film photovoltaic technologies. The U.S. Department of Energy Solar Energy Technologies Office announced the funding results on May 16, 2024. See Table 5 for the details.

III.Numerous local subsidies for the U.S solar industry

State and local governments in the U.S. have also launched numerous subsidies for the solar industry. The DSIRE database records 419 state-level fiscal incentives for the industry and its technological advancement, including rebate programs (87), loan programs (76), property tax incentives (72), PACE financing programs (35), sales tax incentives (34), and grant programs (29). Among all, Colorado enjoys the most financial incentive policies with 26, followed by Texas with 25, and California with 18.

In Colorado, the City of Aspen Rebate Program offers incentives for commercial and residential solar PV installations. The rebate is $200/kW for the first 6 kilowatts and $100/kW thereafter, with a maximum of $3,400 or 25 kilowatts. The Roaring Fork Valley Energy Smart Colorado Energy Efficiency Rebate Program provides a rebate of 25% of the project cost for solar PV systems, up to $2,500.

In terms of favorable financing, Colorado has implemented a statewide Property Assessed Clean Energy (PACE) program that allows commercial property owners to finance 100% of the upfront costs for energy efficiency and renewable energy projects, with financing terms up to 20 years. The Colorado Clean Energy Fund’s Residential Energy Upgrade (RENU) Loan Program offers no-money-down, low-interest loans up to $75,000 for up to 20 years for residential solar PV installations.

Regarding property tax incentives, since July 1, 2006, Colorado has exempted state sales and use tax for all components used to produce AC electricity from renewable energy. For residential properties, renewable energy personal property owned and used by residential property owners to produce energy for residential use is exempt from Colorado property tax.

As for direct grants, the city Boulder in Colorado provides funding through the Solar Grant Program, which offers $1/W, with a maximum of $8,000 or 50% of the total cost.

IV.The solar subsidy policies in the U.S. reflects double standards and will lead to overcapacity

In recent years, the U.S. has frequently accused China’s new energy sector of excessive subsidies. Simultaneously, it is aggressively expanding its solar capacity through exclusive and discriminatory subsidy policies, demonstrating typical double standards. These actions will lead to overcapacity in the U.S. and impact the healthy industry development worldwide. After the implementation of the Inflation Reduction Act, planned solar capacity in America has significantly increased. According to the Solar Energy Industries Association (SEIA), as of October 2023, the U.S. has 25 module production lines, 2 polysilicon suppliers, 9 inverter suppliers, 2 photovoltaic glass suppliers, and 1 backsheet supplier. The operating capacity includes 13GW of modules and 40,000 tons of polysilicon. Under construction are 19.4GW of module capacity and 3.3GW each of cell, wafer, and ingot capacity. Additionally, there are announced plans for 45GW of cell capacity, 80GW of module capacity, 14GW of ingot capacity, and 27GW of wafer capacity. According to Wood Mackenzie, based on current plans, U.S. solar module capacity will exceed 120GW by 2026, three times of the domestic demand for solar installations at that time.

The U.S. solar subsidy policies, represented by the Inflation Reduction Act, disregard multilateral trade rules, making the use of domestic goods rather than imported goods a condition for obtaining subsidies. These discriminatory policies blatantly violate the U.S.’s national treatment obligation under the WTO rules. On March 26, 2024, China filed a complaint with the WTO regarding the relevant policies in the U.S. Inflation Reduction Act. After unsuccessful consultations with the U.S., China requested the WTO to establish a panel to review the case on July 15. Regardless of its camouflage, the subsidies demonstrate the clear essence of violation of rules,discrimination and protectionism of the U.S.solar subsidy policy.