The year 2022 has not been an ordinary year for solar PV professionals. The surge in supply chain costs, the growing popularity of n-type technology, and the booming solar installations in the EU, Asia, and Latin America all mark this remarkable year in the history of the solar PV industry.

At the end of this historic year, we have summarized the trends in the solar supply chain.

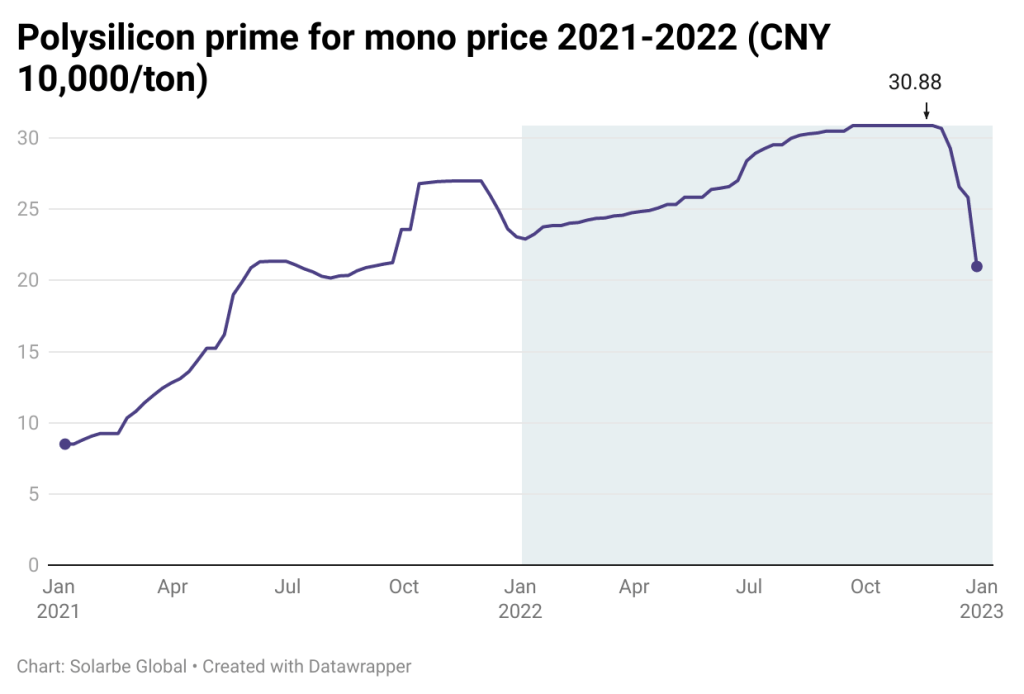

Polysilicon

According to Solarbe Consulting, polysilicon prices have been climbing from January to November 2022. Polysilicon prime for mono, for example, rose from RMB 229.1/ton (~USD 32.97) and reached a peak price of RMB 308.8/ton (~USD 44.44) in September. In December, the price started dropping dramatically to RMB 209.8/ton (~USD 30.19). The prices are expected to further decline in the coming year.

The slump is the result of changes in supply and demand.

At the start of 2022, the annual production capacity of polysilicon was only around 520,000 tons. By the end of the year, the capacity has more than doubled to 1,200,000 tons.

The output in November reached 90,000 tons, enough to support the production of 35.57 GW of modules. However, the output of modules of the month was only 25.42 GW.

The tight supply at the start of the year has turned into a structural surplus, leaving newcomers under mounting pressure.

Industry expert Zhang Zhiyu predicted that the price of polysilicon could drop to RMB 120/ton (~USD 17.27) in the first quarter of 2023, further declining to RMB 85/ton (~USD 12.23) in the third and RMB 65/ton (~USD 9.35) in the fourth.

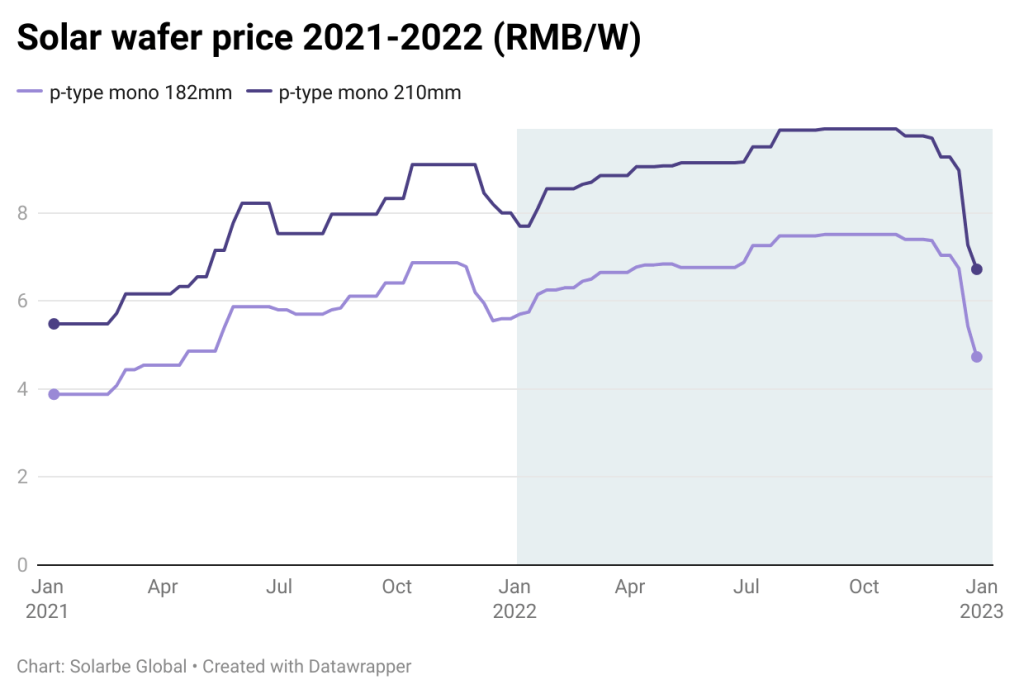

Wafer

At the beginning of 2022, the mainstream thickness of the p-type wafer was from 160-165μm. It has been reduced to 150μm in December, while the mainstream thickness of the n-type wafer is 130μm.

Some manufacturers have revealed that they are trying to produce TOPCon solar cells on 120μm wafers and heterojunction (HJT) cells on 100μm wafers.

The thickness reduction is largely attributed to the surge in polysilicon prices in upstream.

On the one hand, cell and module manufacturers were faced with squeezing profits. On the other, technological advances have ensured the quality of cells and modules using thinner wafers. Therefore, it is natural for manufacturers to choose thinner wafers with fewer costs.

Like polysilicon, wafer capacity is also in surplus.

Solarbe Consulting’s data shows that, by the end of November, the annual production capacity of wafers has exceeded 550 GW, far exceeding demands. Some manufacturers had to sell at a discount to destock.

As a result, wafer prices plummeted in December after slowly climbing in the first 11 months. LONGi and TCL Zhonghuan, two major wafer producers, have both slashed their wafer prices by up to 27%.

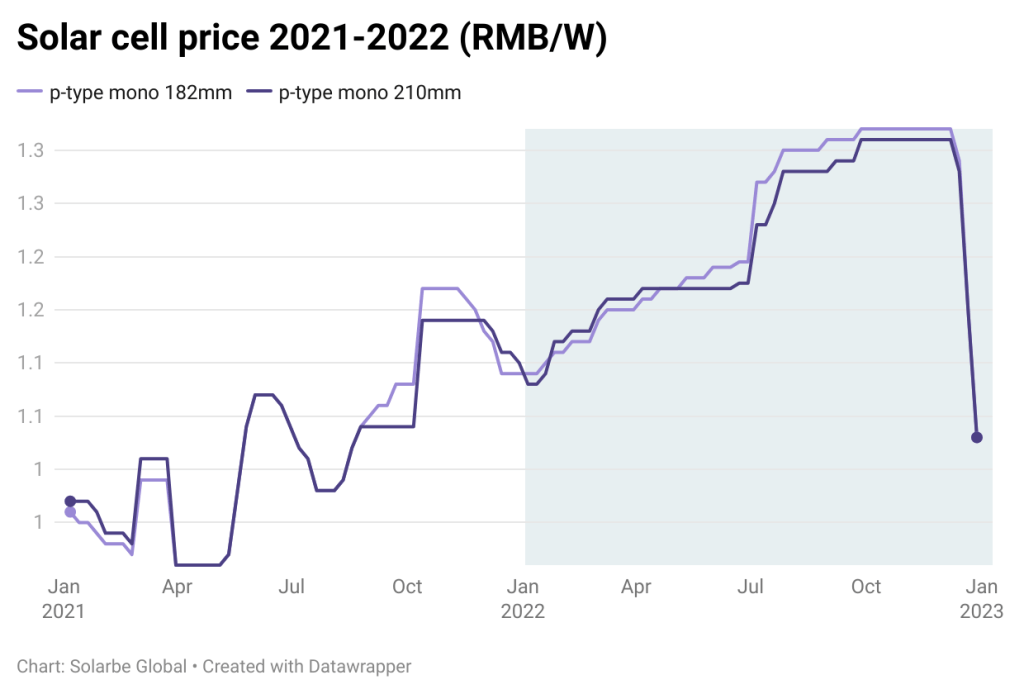

Cell

The conversion efficiency of modules is one of the keys to improve a solar project’s power generation performance. And cells are the most essential part of modules.

As the most tech-heavy sector in the supply chain, cells have a low profit margin. Caught in the middle of the supply chain, cell manufacturers have found it hard to transfer cost pressures downstream when faced with ascending wafer prices.

Wafer price reduction in the fourth quarter, however, has left cell manufacturers some room to breathe. The latter reduced their prices two weeks later than the wafer price slumps, slightly improving their profitability in the last quarter of 2022.

Some analysts believe that the overcapacity of p-type cells is likely to be seen in 2023. To maintain the market share of p-type cells, some enterprises may lower their prices next year to widen the price difference with n-type cells.

Module

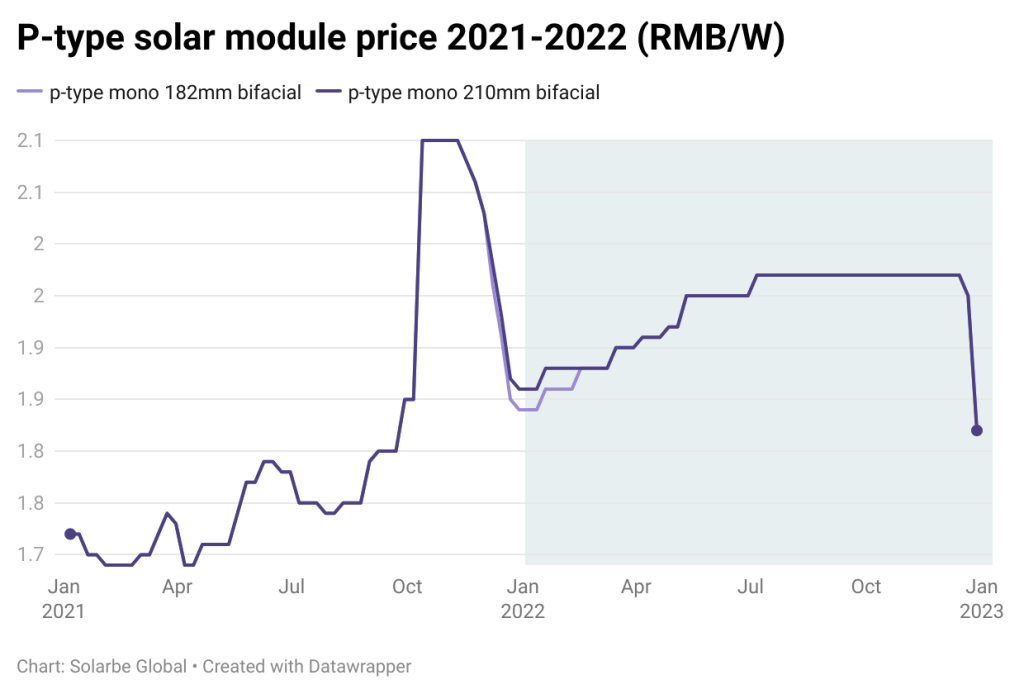

At the start of 2022, bifacial p-type modules were priced around RMB 1.85/W. With the price hike in the upstream, module prices almost hit RMB 2/W at the highest. The prices for distributed projects have exceeded RMB 2.05/W.

Starting in December, the prices quickly fell, throwing the module market into chaos. Some projects that were in a rush to install received quotations above RMB 1.9/W, while the average price was reduced to RMB 1.82/W.

Some modules from private sources have seen RMB 1.55/W and even lower prices. However, the quality of these modules cannot be guaranteed.