COP 27 has just closed in Egypt. As an annual conference held by the United Nations, the event has seen initiatives launched and agreements signed to support renewable energy transition in Africa. Governments and banks have committed to offering more financial support to the continent for the development of renewable energy.

To discuss ways to promote solar deployment in the continent, Solarbe has invited experts in Africa’s solar market for a webinar on November 24.

Omar Taoufik, Senior Account Manager of Yingli Solar, said that the MENA region is an important market for the PV industry, especially for manufacturers like Yingli.

Having shipped 30 GW of solar modules to over 100 countries worldwide, Yingli has established prominent presence in the MENA region with a large portfolio of solar projects. The company is involved in the development of the largest bifacial project in the Middle East, the Oman IBRI 2 project with 117 MW of installation capacity. In North Africa, the company has supplied modules to a 233 MW project in Algeria.

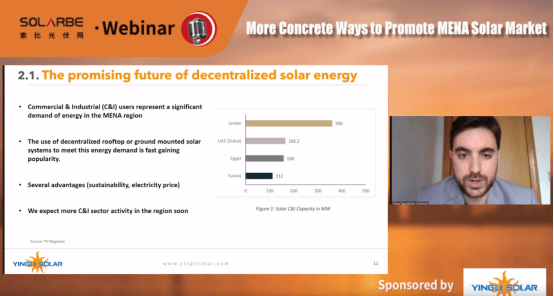

Taoufik further focuses on the promising future of decentralized solar energy in the MENA region.

“Commercial and Industrial (C&I) customers account for a large share of energy demand in the MENA region,” said Taoufik. “The residential sector accounts for 41% of the total power demand, followed by industrial and commercial sectors at 21% and 20% respectively.”

Taoufik went on to introduce three major business models for C&I clients in the MENA region, including EPC/CAPEX model, lease model and the Build-Own-Operate-Transfer model.

As for leading renewable energy countries in the MENA region, he said that Morocco is the leader in the entire region by citing MIT Technology Review. The country has set the goal of reaching 42% of electricity production from renewable sources in 2020, and 52% in 2030. The country is also planning to build the Xlinks Morocco-UK Power Project, which is a mega renewable energy project with a capacity of 10.5 GW to power almost 1.7 million homes in the UK.

UAE is another major renewable energy country in the region that aims for 44% renewable energy by 2050, a target set in the country’s National Energy Strategy 2050. The authorities will review the strategy every five years, said Taoufik.

Timo Schäfer, Finance Director at EWIA Green Investment, a Munich-based investment company for Africa, elaborated on C&I investments in West Africa and Sub-Sahara Africa.

As a solar investor in the C&I sector, EWIA develops solutions for C&I customers through the installation of PV systems and provides exclusive financing and investment solutions for its customers.

Deal announcements are piling up recently in the region, said Schäfer, with the Starsight Energy and SolarAfrica Energy merger to develop 220 MW portfolio, and Shell to install 400 MW by 2025 through the acquisition of Daystar Power Group, etc.

He further stressed that the C&I sector is a “very interesting market” in the Africa, because the continent’s utility-scale solar is still underdeveloped considering its huge solar PV potential.

“Solar energy is now the fastest-growing renewable energy source in Africa. Between 2011 and 2020, solar capacity in Africa grew at an average compound annual growth rate of 54%. Total solar additions over the past decade amounted to 10.4 GW,” said Schäfer.

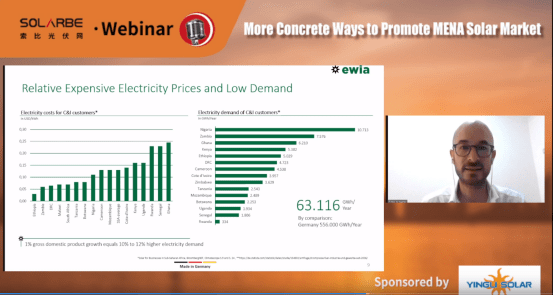

He added that the electricity cost for C&I customers in Africa is relatively more expensive than other markets, while the demand is huge. What’s more, Africa’s growing GDP means higher electricity demand throughout the continent, which will bring huge opportunities for solar power.

Ghana, Burkina Faso, Nigeria, Tunisia, Uganda, Sierra Leone, Senegal, Cote d’Ivoire, Liberia, Tanzania, Congo, Namibia, South Africa are all regarded by EWIA as interesting C&I markets with growing potential.

In the Q&A session, Schäfer said that African countries could employ more capital for the C&I sector. EWIA’s customers have found it difficult to finance their solar projects through local banks, because the interest rates in the region will make the whole business case dense. “That’s why it is so important that international investors are entering with much more power in Sub-Sahara Africa,” said Schäfer.

Taoufik added that the demand for renewable energy is huge in these countries, but the markets are still not mature as the residential market’s potential is yet to be discovered.