Silicon

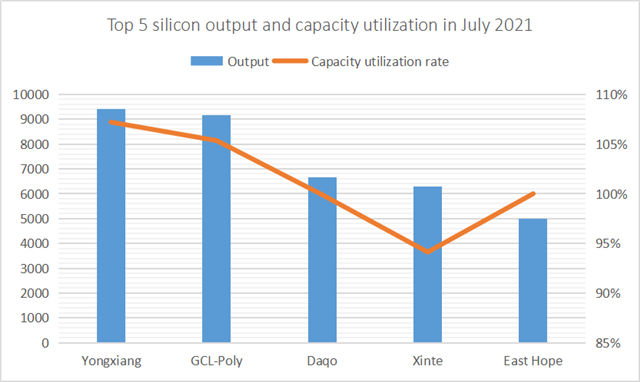

In July 2021, the domestic silicon material output was 42,000 tons (about 14.5 GW), an increase of 5.0% month on month, due to the maintenance and production expansion of Xinjiang Daqo, Xinte Energy, East hope and other enterprises. The total output of top five enterprises was 36,500 tons, accounting for 86.6% of the domestic total, and the comprehensive operating rate was 101.3%.

In terms of supply, some enterprises planned maintenance in August, and the output is expected to decline slightly, with limited impact. Modules are in high demand, with the gradual release of expanded production capacity of silicon wafer enterprises such as Gaojing, and the resumption of procurement by first-line silicon wafer enterprises. The superposition of these factors strongly supports the market demand for silicon materials, which will continue to maintain a tight balance, and the price is expected to rise slightly.

Source: Chinese Silicon Industry, Solarbe Consulting

Wafer

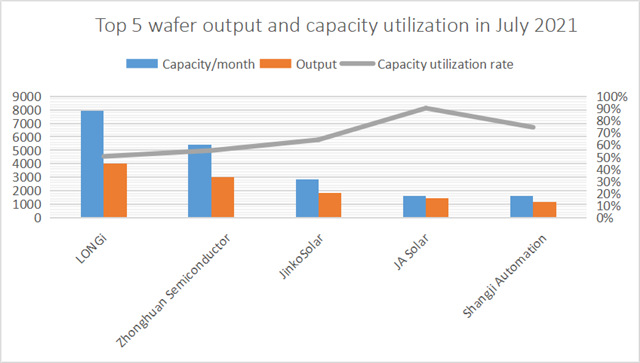

In July 2021, the wafer output was 15.68 GW, a month on month decrease of 11.56%, and the comprehensive operating rate was 67.78%. The top five output included Longi, Zhonghuan Semiconductor, JinkoSolar, JA Solar and Shangji Automation, with a total of 11.4 GW, accounting for 72.89% and a comprehensive operating rate of 67.0%.

Silicon wafer enterprises may usher in a new round of installation rush in August, and the inventory is reduced, resulting in most enterprises start to resume silicon material procurement and signing orders. The recovery of terminal demand prompted cell manufacturers to gradually resume the procurement of wafers, stimulating the operating rate of wafer enterprises to rise.

Source: Solarbe Consulting

Cell

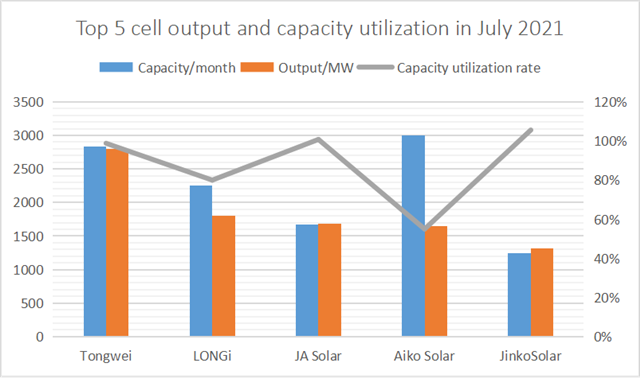

Since this year, the output of cells has increased for the first time. In July 2021, the cell output was 17.05 GW, up 11.84% month on month, and the comprehensive operating rate was 74.11%. With the gradual recovery of module demand in Q3 and the increase of module orders, some cell enterprises have successively signed orders.

On the whole, the comprehensive operating rate of vertically integrated enterprises was over 87%, and the capacity utilization rate of mainstream cell enterprises has increased slightly, with a comprehensive operating rate of 66.9%. According to the downstream demand, the cell operating rate is expected to continue to rise in August. In July, Tongwei, Longi, JA Solar, Aiko Solar and JinkoSolar ranked the top five cell output, with a total of 9.25 GW, accounting for 54.25% and a comprehensive operating rate of 88%.

Source: Solarbe Consulting

Module

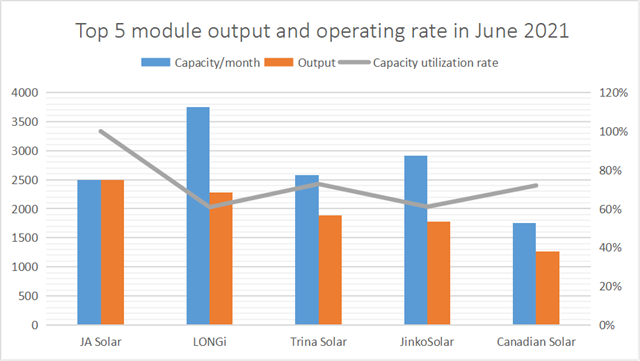

In July 2021, the total output of modules was 17.07 GW, with a month on month increase of 18.78% and a comprehensive operating rate of 79.78%.

JA Solar, Longi, Trina Solar, JinkoSolar and Canadian Solar ranked top five for output in July, with a total of 9.7 GW, accounting for 56.8%, and the comprehensive operating rate was 73.3%, steadily rising compared with the first half of the year. According to recent bidding results, the quotation of modules showed a slight downward trend, but the prices of silicon, wafer and cell increased in August, and the module price is expected to rise slightly.

Source: Solarbe Consulting

About Solarbe Consulting

Relying on Solarbe, the authoritative media in the photovoltaic industry, Solarbe Consulting focuses on data and industry research. It provides photovoltaic enterprises with market data, enterprise consulting, price trend, enterprise analysis, market research, customized report and other services, helping enterprises make correct decisions in sales, production, expansion and decision-making.