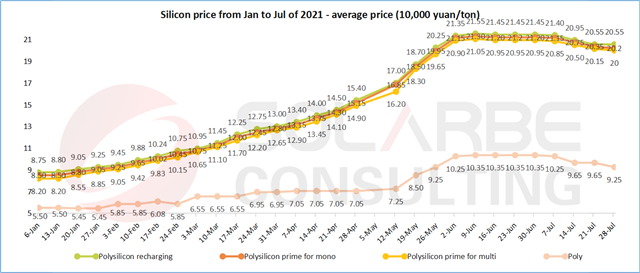

According to the annual installed capacity of 60 GW, 13 GW has been completed in the first half of the year. The silicon material supply is far from enough for remaining capacity. However, Solarbe Consulting believes that the silicon material price will not rise again simply because of the imbalance between supply and demand. Due to the rise of silicon price, cell and module ends have been under huge cost pressure, the profit space has been compressed for a time, and even loss operation has occurred. It is reported that in August, cell and module enterprises may unite to ask for a reduction in the price of silicon.

Silicon

Silicon prices continued to decline slightly this week. The operating rate of large first-line silicon wafer factories remains at a low level, and the demand has not recovered. Due to the installation rush in the second half of the year, it is expected that the market will gradually enter the peak installation of this year since August, and the demand will be pulled again at that time. At present, the supply of silicon material is in a short-term surplus stage compared with the demand, resulting in a continuous slight decline in the price of silicon material.

This week, the average recharging material price of monocrystalline is RMB 205,500 yuan/ton, RMB 202,000 yuan/ton polysilicon prime for mono, a month on month decrease of 0.74%, and the average price of polysilicon prime for multi is RMB 200,000 yuan/ton, a month on month decrease of 0.74%. The price of polysilicon decreased the most, with an average price of RMB 92,500 yuan/ton this week, down 4.15% month on month.

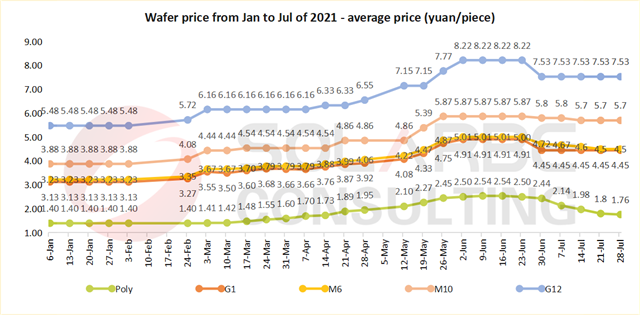

Wafer

The average price of monocrystalline silicon wafer this week was the same as last week, and the price of poly wafers continued to decline.

In terms of monocrystalline wafer this week, the average price of G12 is RMB 7.53 yuan/piece, 5.7 yuan/piece for M10, 4.5 yuan/piece for M6, and 4.45 yuan/piece for G1. The average price of polysilicon wafer was RMB 1.76 yuan/piece, down 2.22% month on month.

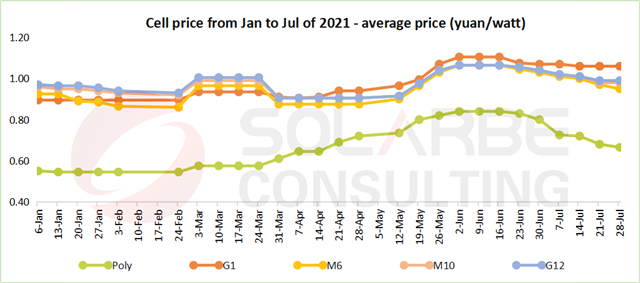

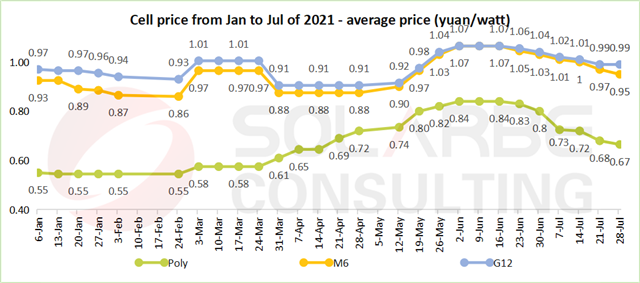

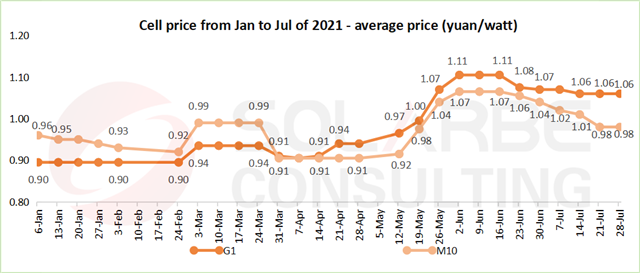

Cell

This week, the price of M6 cell continued to decline, and the price of monocrystalline cells of other sizes was the same as last week. The reduction ratio of polycrystalline cell corresponds to that of wafer.

From the perspective of size, the cost advantage does not subject to size. As long as the cost of kilowatt hour electricity is low and the income of the power station can be guaranteed, any size and technical cells and modules can be adopted. However, there is no doubt that the market is accelerating the elimination of M6, due to the trend. With the large-size application, all manufacturers follow the trend. The new production line is compatible for those below 210mm, and the old production line is upgraded to 182mm.

In terms of monocrystalline cells, the average price of G12 was RMB 0.99 yuan/W this week, 0.98 yuan/W for M10, 1.06 yuan/W for G1, and 0.95 yuan/W for M6, down 2.06% month on month. The average price of polycrystalline cells was RMB 0.67 yuan/W, down 2.21% month on month.

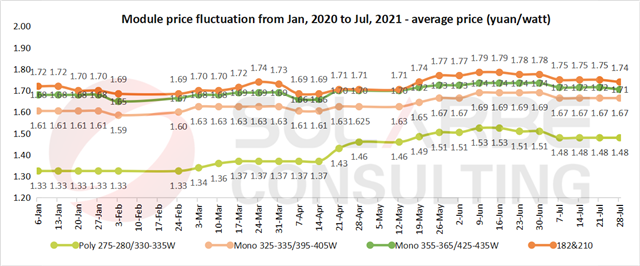

Module

The price of large-size modules slipped slightly this week. Without a significant reduction in the price of silicon, the price of modules will not decline. From the latest tender price, the average bidding price exceeds RMB 1.80 yuan/W.