Solarbe recently was invited to attend the Photovoltaic Technology Conference in Japan and delivered a speech on "Photovoltaic 6.0 Era", here is the original speech in English.

Hello, everyone! I am Cao Yu, the chief editor of Solarbe.com, and the chief analyst of Solarbe Data. I am pleased to be invited to make a short presentation to share and talk about the development of 210mm silicon wafers and 600W modules in the PV industry over past years and the industry competition logic behind it.

Since last August, LONGi and Tianjin Zhonghuan Semiconductor have introduced different sizes of silicon wafer products. This has led to an upgrade in the size of silicon wafers, batteries and modules, which has split the industry. I call it "PV Confrontation", because the interests are totally different for each other, and the impact on the industry is profound and the competition is fiercer than ever before.

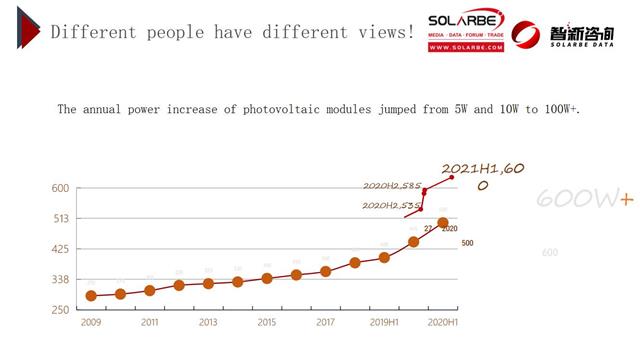

The annual power increase of photovoltaic modules jumped from 5W and 10W to 100W+.

At present, the photovoltaic industry has been divided into two groups, one for 600W+, and the other supports 182mm wafers.

The industry estimates that the capacity of 210mm cells will reach 157GW and the capacity of modules will reach 129GW in 2022.

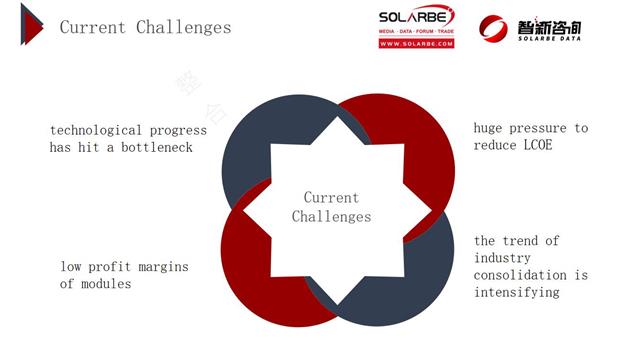

Then why is the competition so fierce? The answer is to survive.

Due to various reasons, such as low electricity price, expensive land and high financing cost, China lags behind most of the regions in the process of grid parity. The countdown of grid parity gives lots of pressure to Chinese PV enterprises, they had to look for the technology and production mode which can reduce LCOE, different from the previous time, PV companies can more easily achieve the government's goal of reducing costs, the stress of reducing costs is intense this time, so the industry entered the era of actuarial science, seeking the best solution, not only qualified.

In 2018, the net profit of most module companies was less than 1%; In 2019, the net profit of leading module companies were around 3%-5%, but the pressure of industrial upgrading is also increasing.

The theme of today's conference is "Advanced Technology is Not Popular in Japan". I would like to say that China's photovoltaic technology is advancing rapidly, but the situation is also brutal at the same time.

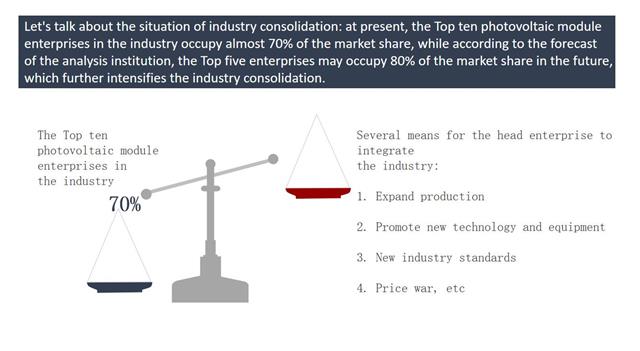

As for the industry consolidation, at present, the top ten photovoltaic module enterprises in the industry occupy almost 70% of the market share, while according to the forecast of the analysis institution, the top five enterprises may occupy 80% of the market share in the future, which further intensifies the industry consolidation.

Same thing also happened in inverter industry.

In the past two years, a large number of Chinese photovoltaic enterprises have been listed on the market. On the one hand, the market is prosperous and the performance of enterprises is relatively good, which is favored by the capital market. On the other hand, it is also caused by the increasing competitive pressure.

In June 2019, the emergence of 166mm silicon wafers started the industrial upgrading debate and competition. When this technology appeared, many module enterprises in the industry resisted, because any industrial upgrading initiated by the leading enterprises was to further consolidate their dominant position. Although the 166 equipment can be transformed on the original basis, it still costs a certain amount of cost, and it is not as good as the new capacity. Therefore, this upgrade will bring a certain impact to the enterprises with larger production capacity.

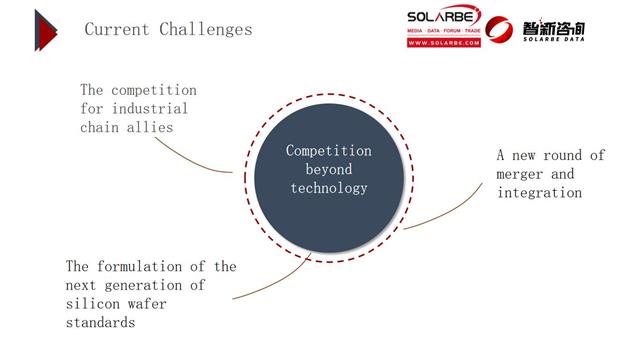

The competition is not limited to the technology itself: competing for the allies of the industrial chain, formulating the next generation silicon wafer standards, and occupying the first opportunity in the new round of merger and integration are all related to the survival of enterprises. I have mentioned that the current competition in China's photovoltaic industry has changed from homogeneous competition to technological competition, which is more dangerous and requires the joint efforts of the industrial chain. Therefore, this is why the competition between 166 and 210 is so fierce.

So, what value will the new 210 technology bring to the industry? What's so good about it? Is it mature?

Technical analysis

M12 large-size silicon wafer, with side length of 210mm and diagonal angle of 295mm, has a surface area of 80.5% higher than that of conventional M2 wafer, 75% higher than G1 (158.75mm), 71% higher than M4 (161.7mm), and 61% higher than that of M6 (166mm).

Significance to the industry

The biggest value of 210 technology is that it is an industry-wide, inclusive technology. Enterprises of silicon wafers, cells and modules can reduce non-silicon cost by improving production efficiency and improve module efficiency by improving cell area ratio. For investors, high-power modules save land, support bracket, and labor costs, resulting in cheaper PV costs, a broader market, and a more dynamic and reasonably profitable PV industry. It should be noted that in terms of the non-silicon cost reduction, the fully developed 210 modules will compete with other modules, so the price per watt will be the same as other modules or even slightly higher, so this non-silicon cost can be an additional source of profit for these enterprises or can be used for price reduction or market competition.

Technical difficulties

This is Trina Solar's cost reduction strategy for 550W modules. Taking 100MW as an example, the savings in each link range from 11% to 42% compared with 450W modules.

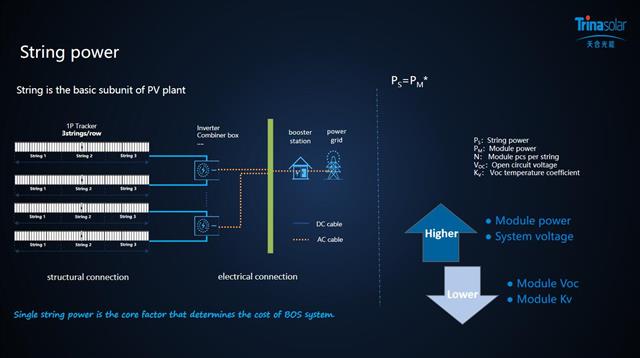

After calculation, the lower the module opening pressure, the lower the BOS cost. This is also a big advantage of the 210 module.

Current situation of industrial chain

In the past, the investment enterprise earns only 8% of the profit, even if there is any surplus, it is taken by the project developer, so they are not interested in technological progress. With the acceleration of the grid parity process, however, it is difficult for some regions to achieve grid parity or the promised electricity price during bidding, and can not get the 8% of the profit even if achieving the optimal solution, so they would like to choose the optimal solution more actively.

So that's why the solar modules with 182mm or 210mm wafers are still necessary, even if the weight are increased.

Now I will make a brief introduction of the 600W alliance, and also I want to talk about why the 210 technology develops so fast?

Judging from the number of participating enterprises, it has expanded from 39 to 61 now.

In fact, each enterprise has its own demand and reserve for upgrading, but in the past, such technological progress was fragmented, so the potential has been ignored, and the direction is disordered. The formation of the alliance brings together the technologies of these reserves, forms a cooperation, and indicates the development direction of the industry.

Although 210 technology was widely regarded as uncompetitive compared with 166 technology when it was first introduced, it has proved successful in its current competition. The enterprises with 166 technology have either upgraded to 182 technology or have chosen 210 technology for new production capacity.

For vertically integrated manufacturers in the whole industrial chain, there is great pressure to upgrade directly to 210 technology. So it is a good transition choice at present to choosing 182 technology, and can also make better use of the existing production lines.

When we focus on a technology, we are very concerned about the following points: theoretical basis, the present situation of industry and technology bottleneck, There are few insurmountable difficulties for 210 technology and at the same time, the direction of technological development is in line with the trend of photovoltaic industry moving towards lean manufacturing. so I firmly believe that 210 technology will become the mainstream of PV industry, the value of simply increasing the size of photovoltaic modules will decrease, and new business logic will certainly appear.

The PV industry is changing so fast that every practitioner in it feels excited, joyful or painful. It's hard to succeed if you are too conservative.

Japan takes the lead in many segments of the photovoltaic industry, and China has created the most passionate and transformative photovoltaic market. As the largest photovoltaic media in China, Solarbe is here to work together with you to better open the photovoltaic technology cooperation and exchanges between China and Japan.